Here’s what caught my attention in the payment space this week.

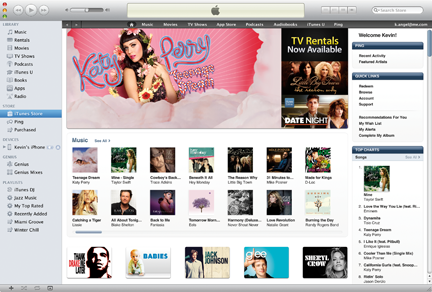

Jobs: 200 Million Apple IDs

Just slightly overshadowed by Steve Jobs’ introduction of the thinner, dual-camera, black-or-white (but still somewhat evolutionary) iPad 2 was his announcement that 200 million people now have Apple ID accounts. Jobs noted that Amazon doesn’t release comparable numbers for the accounts it holds, but suggested that this may be the largest collection of credit-card-backed accounts anywhere on the Internet. If it were a country, iTunes would be the fifth largest in the world, smaller than Indonesia but bigger than Brazil.

Just slightly overshadowed by Steve Jobs’ introduction of the thinner, dual-camera, black-or-white (but still somewhat evolutionary) iPad 2 was his announcement that 200 million people now have Apple ID accounts. Jobs noted that Amazon doesn’t release comparable numbers for the accounts it holds, but suggested that this may be the largest collection of credit-card-backed accounts anywhere on the Internet. If it were a country, iTunes would be the fifth largest in the world, smaller than Indonesia but bigger than Brazil.

Jobs gave some other interesting numbers: developers have earned more than $2 billion through the App store and 100 million books have been sold through the iBooks store — an impressive number for the lesser-known third of Apple’s trilogy of stores. It remains to be seen whether Apple has ambitions for its 200 million accounts beyond selling digital goods. Certainly there’s a treasure trove of information in there about buying behavior and the opportunity to sell more through the stores. For now however, Apple seems content to keep its iTune members — and its plans for them — close to its chest.

Hearst Media’s least sexy product: online bill portal

Hearst Media wants to cash in on its know-how in managing subscription renewals by creating a bill-paying portal that would compete with the post office to deliver bills and other barely wanted communications to the paying public.

On Monday it launched the beta version of Manilla (named for manilla folders), which Hearst is pitching as a place to manage all your accounts, bills, frequent flyer miles, and reward programs. Manilla is free for consumers; billers pay monthly for every customer they convert to paperless billing — a small amount, but something that Hearst hopes will add up. And there will be advertising in the bills.

On Monday it launched the beta version of Manilla (named for manilla folders), which Hearst is pitching as a place to manage all your accounts, bills, frequent flyer miles, and reward programs. Manilla is free for consumers; billers pay monthly for every customer they convert to paperless billing — a small amount, but something that Hearst hopes will add up. And there will be advertising in the bills.

The new venture is led by George Kliavkoff, whose background includes leading NBC Universal’s digital efforts and helping to develop Hulu. Kliavkoff told David Kaplan at paidContent.org that the idea came from looking around to see which areas were “the most inefficient and the ones most ripe for disruption.” According to Kliavkoff: “That’s where we started the idea of tackling junk mail … Essentially, we’re challenging the US Postal Service’s business.”

They’re entering a crowded field that includes not only other third-party financial management sites like Mint.com, but also just about every bank and credit union that offers online banking. Still, with traditional media models crumbling, and media, marketing, and financial companies all pretending to be each other, who can fault an old-school media company for challenging an even older institution?

Reports of the death of credit cards are greatly exaggerated

While Hearst takes aim at one icon of the 20th century (the US Post Office and its junk mail delivery), online payments services are taking aim at another: the credit card. Back in the “Mad Men” era it may have been the height of smooth to drop a Diners Club card on the silver tray after dinner. But the card was never designed for online or mobile payments, writes PayPal’s Bill Zielke on Mashable. Zielke notes that the recession contributed to a decline in use of credit cards for online purchases — down from 44% of online purchases in 2009 to 40% in 2010. He suggests this trend will get worse even as times get better. For exhibit A in his argument that credit cards and the Internet are a poor match, he cites the ridiculous act of typing a 16-digit code over and over again to make purchases. He argues that the ubiquitous cards will fade over time in favor of “services that were designed for the online experience from the start.”

PayPal would prefer users link their online payments directly to bank accounts so that it wouldn’t have to pay those credit card interchange fees. Some services like Boku and BilltoMobile are taking a different tack, looking to add those mobile and online purchases directly onto your phone bill.

But the credit card companies won’t slink away quietly. They heard the news that it’s no fun to key in that number, and they’re working on ways to leave that pain behind. This is particularly notable on mobile devices, with programs like Isis (which we wrote about recently) that would make it easy to buy products by swiping or tapping a phone that stores credit card data in the SIM card.</p

And, of course, swiping a credit card hasn’t gone completely out of fashion. Even as online and mobile options try to move away from plastic, Square is making a business by updating the credit swipe in the iPad era — and making a go of it. The closely watched startup announced this week that it was now processing more than $1 million a day.

Hiatus

ePayments week will be taking a two-week break. We’ll return on March 24.

If you’re interested in learning more about the payment development space, check out PayPal X DevZone, a collaboration between O’Reilly and PayPal.

Related: