I recently took a poll on my Sina micro-blog, China’s equivalent to Twitter, asking my readers what brand of phone they owned and whether they were satisfied or wished they had a different phone.

Sina’s readership demographics are weighted heavily around 20-35-year-old white-collar city folk. My poll may not be scientific or exactly representative of the masses country-wide, but it is probably a good sample of the upper-half income bracket of the 300-400 million Chinese living in cities in China.

(Note: 576 of my 30,000+ followers participated in the poll. I had a total of 672 responses — some participants had more than one phone.)

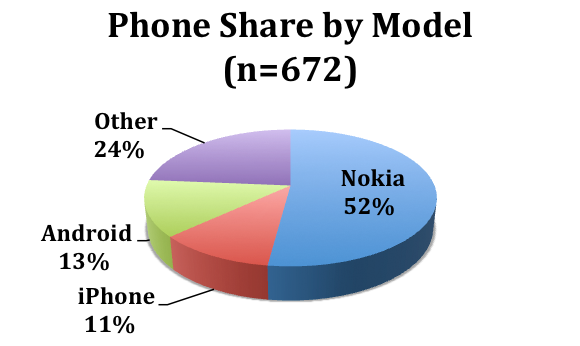

Although Nokia has been steadily losing Chinese market share the past few years, it still dominates in sheer numbers, and the poll reflects that. Slightly over half of my responding readers have Nokia phones, with iPhone and Android phone usage coming in at just over 10% each.

Does mine make you jealous?

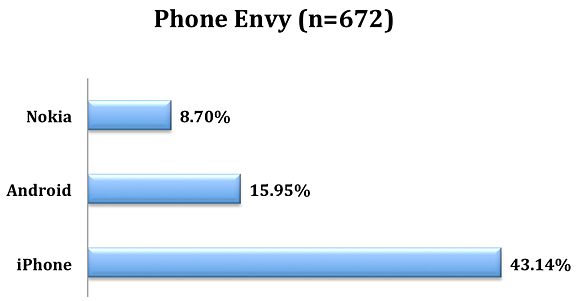

The poll results show that a whopping 43% who don’t already have an iPhone wish they had one. Although Android phones have begun to flood the market, they are not nearly as prized: only 16% of those polled who don’t own an Android wish they did. And poor Nokia … of those Chinese cell phone users who don’t own a Nokia, more than nine in 10 are not likely to buy one.

To summarize, iPhone envy is nearly three times stronger than Android phone envy. Nokia envy is nearly non-existent.

Love the one you’re with?

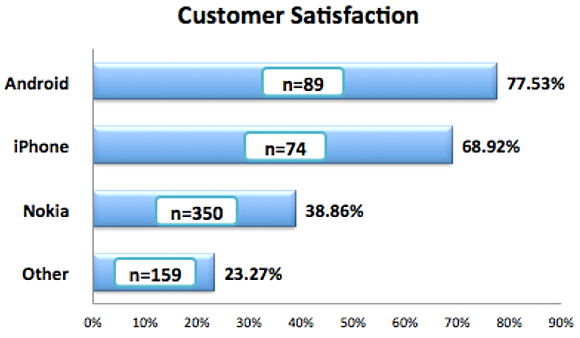

Customer satisfaction is another measure of the health of a brand. Android and iPhone rank relatively high (although not as high as I expected; this may be due to the relatively smaller sample size for iPhone and Android). Indicative of harder times ahead for Nokia, more than half of their users would like to ditch their Nokia phone.

Numbers, money and lust

You might think that even though Chinese want a nice, new, expensive smartphone, price should be a barrier, and few will have the buying power to purchase one. It is not uncommon, however, in China for a “90-hou” (a person born in the 1990s), whose salary may be 1,500 RMB/month ($250/month), to spend a few thousand RMB on a new phone. Add that to the 50 to 100 RMB per month they pay for services from a carrier and Tencent, and it may work out to their spending as much as 30% of their total annual salary on cell phone expenses!

It seems that prestige and status sometimes trump what we take as common sense in purchase decisions. But, for a similar analogy in the US, think of a cowboy in the wild west a hundred-some years ago. He might well have spent a few months’ salary on his hat and his boots — prized possessions that were not only utilitarian, but had a great amount of prestige attached to brand as well. Like Mark Twain said, “Clothes make the man.”

So, what does this poll tell us the future will bring? First, Nokia appears to be charging down the same path to the Chinese graveyard that Motorola took only a few years ago, when it dropped from dominant market share to less than 5% today. Android has good numbers in China, and will sell well, but it lacks the brand momentum the iPhone has. Whether by design or luck, the iPhone seems to have many Chinese lusting after it .

Where 2.0: 2011, being held April 19-21 in Santa Clara, Calif., will explore the intersection of location technologies and trends in software development, business strategies, and marketing.

Where 2.0: 2011, being held April 19-21 in Santa Clara, Calif., will explore the intersection of location technologies and trends in software development, business strategies, and marketing.