Here’s what caught my attention in the payment space this week.

Consumer Reports: Only 5% use mobile payments

In something of a reality check to mobile payment enthusiasts, Consumer Reports says U.S. consumers are still wary of using their cell phones to pay for day-to-day purchases, and only 5% have done so in the past month. Interestingly, that percentage doubles (to 10%) if you include purchases made by charging things to home or mobile phone accounts — a category that could include direct-billing payments like those offered by Zong, Boku, or Bill2Mobile, which are largely used to buy virtual and other digital goods, mostly in gaming environments.

Consumer Reports warned its readers about the hidden costs of mobile transactions, as well as the difficulty in recovering funds if a billing error or erroneous charge appears — something that, the publication says, 1 in 4 Americans have experienced in the past year. Mobile payments linked to credit cards generally offer the most protection in these cases, the report said; the protections offered by those linked to debit cards or phone bills can vary.

Covering the report on GigaOm, Ryan Kim writes that mobile payment providers have their work cut out for them convincing mainstream users that tapping their phone is better than swiping plastic. If they can’t sell the pitch, he notes, an opportunity is open for someone who can. That could be any of several hundred third-party app providers that link location to payment in some beneficial way. For example, the partnership between Foursquare and American Express, which offers an easier way to cash in a location-based coupon by making the discount automatically apply when swiping a phone linked to an AmEx card.

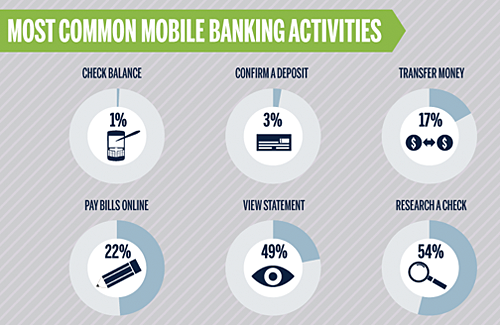

Snapshot of mobile banking

An infographic produced by Lookout Mobile Security, a firm that offers security services for smartphones, offers an interesting snapshot of the state of mobile banking. (The data is compiled from a range of sources, including Juniper Research, NPR.org, ABIResearch.com, and eBay.) The most striking aspect to me is how low some of these numbers are:

- Only 10% of banking households use mobile banking.

- Only 9% of consumers opening new bank accounts said a mobile app was important to them.

- Only 22% of consumers who use mobile banking use it to pay bills.

Segment from Lookout Mobile Security’s “Mobile Banking on the Go” infographic. Click to see the full graphic.

The graphic also reports that 51% of U.S. banking customers don’t trust the security of mobile banking apps — a number that seems lower than I might have expected, given the hesitation reported by consumers in surveys like the Consumer Reports one noted above.

iPhone 5 Rumors: Apple + PayPal

There’s more speculation this week as to whether the iPhone 5, which is predicted to roll out in September, will include a payment capability. While the news cycle around “the next iPhone” is a perpetual stream of rumors, they don’t always turn out to be false. I’m seeing a consensus emerging that the iPhone 5 may have NFC (near-field communication) chips, but no solid explanation of what Apple may do with them.

This week’s rumors suggest that Apple may partner with PayPal to create a payment channel for goods in the wider world beyond the iTunes store. (Apple, of course, doesn’t need NFC or a partner to enable payment for digital goods.) NFC would turn the iPhone into a device that could be used to pay for goods in the physical retail world — provided that the merchant has a point-of-sale device capable of communicating via NFC.

PayPal and its parent eBay have made a string of acquisitions this year to strengthen their payment capabilities online, in the mobile space, and in the physical retail space. Ebay’s announcement in June that it would buy the rest of open-source economic platform developer Magento complemented its acquisition of GSI Commerce, which provides ecommerce services for physical retail chains. In the web and mobile native worlds, eBay has picked up Milo, which helps consumers find local deals, Where, which offers location-based ad services, and Fig Card, which offers payment channels to merchants. Put them together and it creates a soup-to-nuts commerce channel that could inspire a partner like Apple to wonder, “Why bother re-creating this?”

Got news?

News tips and suggestions are always welcome, so please send them along.

If you’re interested in learning more about the payment development space, check out PayPal X DevZone, a collaboration between O’Reilly and PayPal.

Related: