In this second installment (the first post can be found here), we look at computer book sales in specific technology categories.

Remember that we’ve organized the data into six “Category Families” — Systems and Programming, Web Design and Development, Business Applications, Digital Media Applications, Consumer Operating Systems and Devices, and Computer Topics.

Within each of these Families are category group, super-category, category, and atomic category, in a five-level hierarchy. For example, Systems and Programming includes the category groups programming languages, databases, software engineering, general programming, security, and so on.

In the rest of this post, we will contrast 2011 with 2010.

As a refresher, here are two treemaps of the Category Families, with their sub-areas for the final quarters of 2011 compared to 2010. The map on the left shows the growth of the count of titles in each area and the map on the right shows the growth in units for each area.

The Treemap on the left shows the number of new titles entering the Top 3000 in 2011. Security General (upper-left center), Data Analysis (left-bottom center), iPad-consumer (middle-bottom center), MacOSX (middle-bottom center) and HTML5 (upper-right corner) where the brightest green growth areas in 2011.

The Treemap on the right shows the top growing areas from a units perspective. The same areas are the top performers, but they have moved around a bit and are larger in some cases which reflects their market share. Again, this is comparing the last quarter of 2011 with the last quarter of 2010. This time period reflects the holiday shopping season and usually the best for consumer topics and not necessarily for the more technical titles which peak early in the new year.

In the next two images, you can see how our Category Families stack up. The image on the left shows the number of titles that made the Top 3000 in a given year. Contrast that with the image on the right, which shows the number of units sold in each year. What you will notice is that the number of titles in Systems and Programming went up in 2011 to its highest level since we began tracking, yet the units sold for the Category has been going down each year. Consumer Operating Systems and Devices and Computer Topics are the two areas that went slightly up in both the number of titles and units sold in 2011. Systems and Programming still is the largest category and is a chief indicator for the health of the computer book market, and it’s been in a consistent decline — for print books. You’ll see some more positive indicators in my upcoming post on digital distribution.

The table below shows each Category Family’s compared growth between 2010 and 2011 (YoY Growth), 2010 and 2011 ranking (10Rank/11Rank) and 2010 and 2011 percent of market share (10Share/11Share).

| Category Families | YoY Growth | 10Rank | 11Rank | 10Share | 11Share |

| Business Applications | -00.45% | 2nd | 2nd | 21.00% | 20.60% |

| Computer Topics / Other | 15.78% | 6th | 6th | 03.15% | 04.11% |

| Consumer Operating Systems | 04.22% | 3rd | 3rd | 15.44% | 17.27% |

| Digital Media | 09.29% | 5th | 5th | 17.27% | 18.58% |

| Systems and Programming | -00.64% | 1st | 1st | 34.62% | 35.02% |

| Web Design and Development | -02.58% | 4th | 4th | 14.32% | 13.72% |

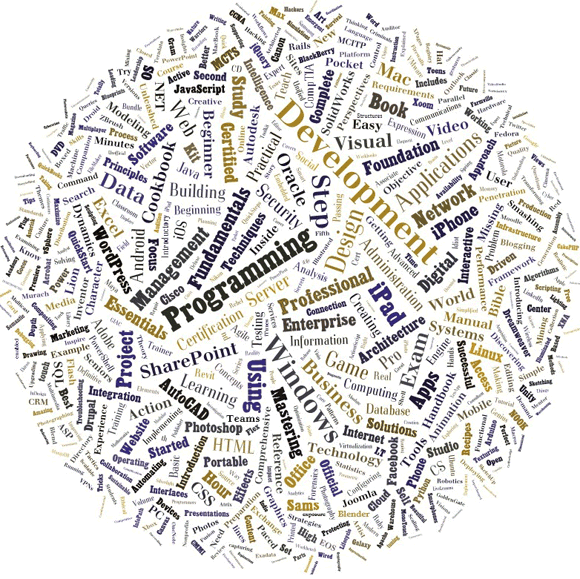

Before we look into categories further, let’s first take a look at the words that make up all the computer titles for 2011. It’s an interesting view of the words that the publishing industry puts on the front of books, online searches, and anywhere there is metadata about content. A note about this data: I threw away the stop-words like “the,” “and,” “it,” “with,” etc. I also disregarded “Microsoft,” since it is a descriptor used for various products and is redundant. Here is the “title” view of the market. What obviously pops to me is Programming and Development, but Data came from nowhere to being a discernible word on the image [located @ 10:00 on a clock].

As the market keeps declining, the response of many publishers is to increase the number of titles published, in an attempt to gain market share. Immediately below are two bar graphs showing the trend for how many titles made it into the Bookscan dataset in a given year, and the average units sold is for all titles. So this is the non-obvious point here: There are not necessarily more titles being published, but more titles making it into the dataset. This could be attributed to a lower threshold to get in. In other words, some weeks the threshold to make the Top 3000 list can be as low as 1 unit sold. It is a relative measure. The last couple of years have had lower thresholds, and thus more titles made the list but with worse average units. When the market is healthy, the threshold moves up and only the solid-performing titles make it into the Top 3000. The lower threshold barrier is resulting in a significant decrease in the average units per titles for all publishers.

When we drill into the category families a bit, we see that seven of our 10 top categories (known as super-categories) sold fewer units in 2010 than in 2009, for a net loss of -244,936 units for just the top 10 areas. In other words, our bigger and typically more stable areas were selling significantly fewer units in 2010. In the first half of 2010, there were 49 super category areas that were ahead in the sales over the first half of 2009, yet six of the 49 categories slowed down and ended up losing enough ground to show a year-over-year decrease in units. We ended up with 43 super-categories producing more units in 2010 than they did in 2009.

The biggest winners in growth order are: Tablet, Mobile Programming, Windows Consumer, Security Topics, Hardware Topics, Social Web, Computers and Society, Cloud Computing, Information Technology, and Data Topics. The Tablet super-category went from roughly 15,000 units in the first half of 2010 to an additional 100,000 units in the second half of the year. An increase in titles fueled this growth — output tripled from 7 titles in the first half of 2010 to 22 titles by the year’s end.

The areas with the largest drop in units were, in descending order: Web Page Creation, Digital Photography, Mac OS, Flash, Web Programming, Web Design Tools, Personal Computers, Linux, Software Project Management, and Personal Database. The category that surprises me the most is Web Programming. Sixteen fewer titles in the Web Programming area made the list in 2010, and only 7% of the titles sold more than 1,000 units, as compared to 11% in 2009.

The table below provides a view of the market’s erosion. The Average Min value represents the “low threshold” weekly average during a given year. The Average Max is the high-range weekly average for a given year. Number of Titles is self-explanatory. You will notice that the years with the highest min had fewer overall titles represented in the data. The bottom line is that as the market erodes, it appears as though we are seeing a watering-down — more titles producing fewer units on average.

| Year | Average Min | Average Max | Number of Titles |

| 2004 | 9.2 | 1,133 | 7,451 |

| 2005 | 9.6 | 1,099 | 7,123 |

| 2006 | 9.6 | 1,315 | 6,881 |

| 2007 | 9.4 | 1,348 | 7,092 |

| 2008 | 8.2 | 1,534 | 7,310 |

| 2009 | 7.3 | 1,057 | 7,557 |

| 2010 | 6.7 | 1,112 | 7,792 |

So it could be said that we’ve been in a bit of a tech innovation slump. But in my opinion we are in a distribution slump or holding pattern. By that I mean that we have print books, digital versions of the same thing, and yet have you seen any really innovative format for a tech book hit the market lately; something like what Khan Academy has done with other parts of education. They certainly have a long way to go to build out a Computer Science Curriculum. I think before publishers say we are in a tech slump, we need to look inside our own walls first and realize that we may be in a publishing slump as our consumers want different educational experiences.

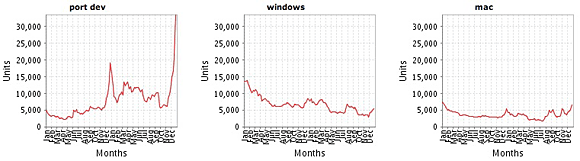

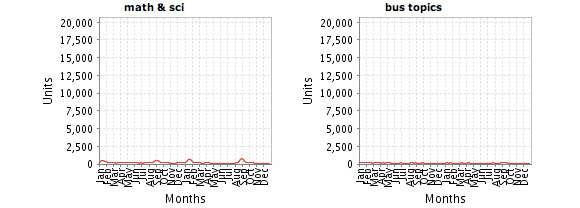

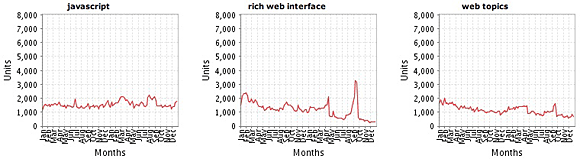

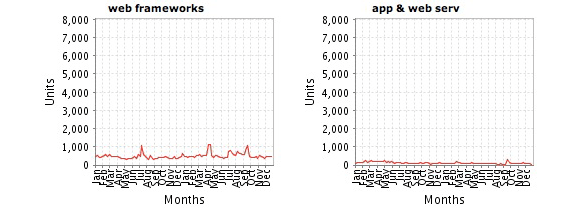

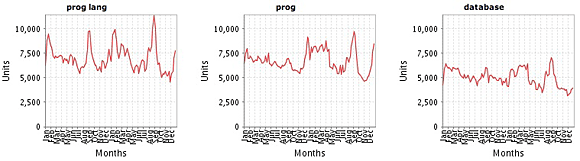

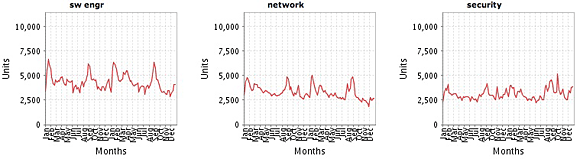

Now let’s look at the categories that comprise each category family. Below are some individual trend charts from our dashboard showing the 24-month period from January 2010 to December 31, 2011 for the major categories. By looking at a 24-month pattern, you get more insight into whether or not a particular area seems to be hit by seasonal factors, and if there is a steady decline/increase for the category. It is important to look at scale on these charts because it visually shows you the relative market size. Another way to think about it is if the trend line is high in the individual box, the category is big, and if it is low, it is a smaller category. What is interesting to note is that Consumer Operating Systems, Digital Media, and Business Applications and Devices all have a January spike, which is likely due to individuals buying “how to” books for their new computers, devices, and operating systems. This is a consistent seasonal pattern.

| Systems and Programming | Business Apps | Consumer Ops and Devices |

|

|

|

| Web Development & Design | Digital Media | Computer Topics |

|

|

|

The Categories (24-month rolling, January 2010 — December 2011)

Clicking on the charts below will produce a larger view. When viewing the charts below, keep the reference charts above in mind. Viewing these jointly provides more context on the size of market and seasonal patterns.

Category_Family: Consumer Operating Systems and Devices

Here are the trend lines for the five main categories (cat_family) that make up Consumer Operating Systems and Devices.

This category is a medium-sized area and was the one of three Category Families to show growth year-over-year. This category’s growth is driven by the iPad, the iPhone and the Nook in the Portable Devices sub-category.

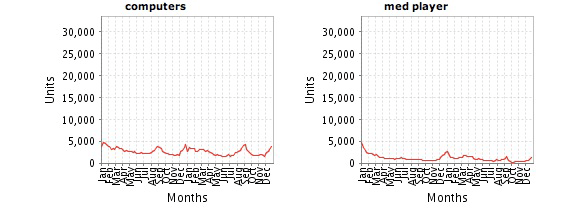

The consumer operating systems and devices market shows ups and downs each year and pretty closely reflects what is going on in the whole market. If you compare the growth of Mac OS X with Microsoft Windows, the Windows books had in increase in 2010 but both declined in 2011. The chart below shows how these two are stacked up against each other. Foreshadowing the 2012 results, I believe that the Windows category will be up because Windows 8 will ship and be a significant upgrade for most. I believe> that Apple will continue to decline as they roll out $29 upgrades that are minimal. The iPad, iPhone, and Android devices will continue to soar.

Category_Family: Business/Office Applications

When comparing the Business Apps area for 2010 and 2011, there were 12 super_cats (one level below cat_family) that performed ahead of the prior year and 21 that underperformed compared to the prior year. The 21 underperforming super_cats only lost 2,090 more units than the 12 positive areas had gained, for an overall -0.44% growth rate.

The three healthiest super categories were Office Suites at 7.49% growth, Collaboration Technologies at 12.43% growth and Social Network (Facebook) at 11.73% growth, while Presentation Topics at -11.88%, Accounting at -8.21%, and Search at -15.30% saw the biggest drop in units for this Business category. It is interesting to see that Spreadsheets is pretty much the same as the market. A very slight uptick in growth, 88 more units in 2011 that 2010, and is still a large super category in rank. Spreadsheets trails only Digital Photography and Tablets for the top spot as the biggest super category.

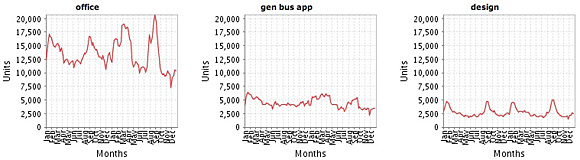

Here are the trend lines for the eight categories that make up Business/Office Applications.

Notice how much bigger of a category “office” is than the other two (“gen bus app” & “design”). But the news in this category is that Office titles have slightly stabilized, having gone from -4.66% decrease last year to a -0.48% decrease this year. This decline mirrors the overall market. The category has been dominated by entry level user books. These sort of entry level books are driven by Series that have consistent promises and both Dummies and Microsoft Press each held four spots in the top 10 best sellers list for this category. This does make sense when you think about it. I said last year that it looked like Dummies have a bit of a book dynasty, so to speak, but in 2011 Microsoft Press rocketed into this space well. The category chart Web Apps is mostly dominated by books on Facebook. Who would have thought you’d need a book on how to use Facebook? These are not programming Facebook APIs, but rather how to use the Social Network. Foreshadowing 2012, I expect that this Category Family will continue to do well as Windows 8 will undoubtedly create more demand for Office books in 2012.

Category_Family: Web Design and Development

Web Design and Development is down -4.36% from 2010 to 2011. Another 37,438 fewer units were sold in this category in 2011 than in 2010. And remember, 2010 was one of the worst years we’ve seen in awhile for this category. There were eight sub areas that showed growth in this category — HTML5 at 74.60% growth and Social Web at 9.36% and JavaScript at 17.32% growth led the way in 2011 for this area. If we combine HTML5 and JavaScript because they are very closely related, the combined growth rate is a healthy 41.39% growth and 45,559 more units sold in 2011. O’Reilly has three of the top five books in this area with Learning PHP, MySQL, and JavaScript leading the category in unit sales for two years in a row. Head First HTML with CSS & XHTML and JavaScript: The Good Parts also cracked the top five for us.

The areas that surprised me the most, though, were Web Programming which saw ~25,152 fewer units sold in 2011 than in 2010 or a -23.61 growth. And closely behind was Web Design Tools that produced -16,534 fewer units for -23.67% growth and Web Development producing -11,684 fewer units and -28.54% growth. Yet HTML5 and JavaScript are growing. This is a bit perplexing but could be attributed to developers wanting more specific topics rather broad reaching topics and tools. In Web Design Tools it is mostly Dreamweaver’s fall that puts this category down. In Web Development it is Website creation type of books for “beginners” and “dummies” that have fallen the most.

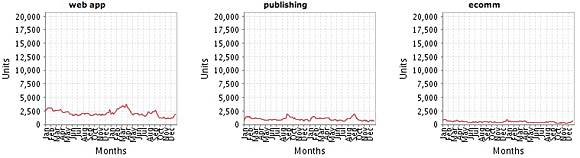

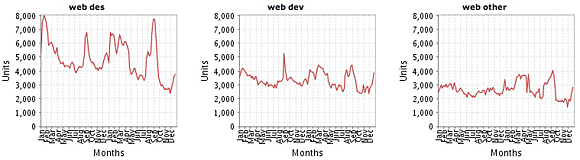

Here are the trend lines for the eight categories that make up Web Design and Development.

Obviously the big sub categories here are “web design” and “web development.” It is dominated by titles that talk about performance, scalability, reliability, and tuning. Similar to what you will find at our Velocity Conference. Foreshadowing for 2012, the area to watch is JavaScript. Doesn’t everyone need to know and learn JavaScript?

Category_Family: Systems and Programming

This is the largest of our top-level category families. It is the place where most of the programming language, database, and software development titles reside. There are now 73 super_cat subcategories (super category) in this area and in 2011, 46 of the areas were negative year-over-year and only 27 areas had growth. There were -68,0295 fewer units sold in these areas during 2011. This is only a -3.14% decline, so this large family of titles actually performed slightly worse than the overall market. Mobile Programming and Data Analysis were the two biggest growing areas. Mobile Programming produced 30,636 more units for a 38.84% growth rate while Data Analysis produced 22,925 more units for 22.42% growth rate in 2011.

The top five performing categories, in order, were Mobile Programming, Data Analysis, Security Topics [+9,648 units / 5.53% growth], Java [+7,316 units / 7.33% growth], and Python [4,886 / 10.55% growth]. The categories with the worst performance, in order, were IT Certification [-19,078 / -31.50% growth], Windows Administration [-14,852 units / -14.13% growth], Microsoft Programming [-13,491 / -27.70% growth], C# [-12,993 units / -20.26% growth], and Network General [-11,234 / -19.04% growth].

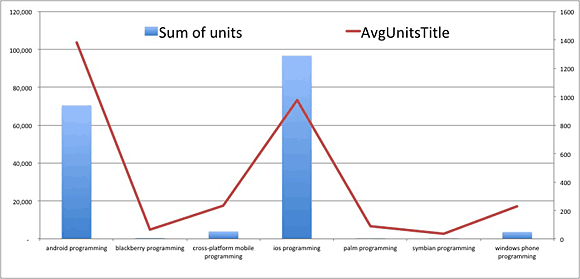

In the top performing area of Mobile Programming, iOS was nine times as large as Android in 2009, and roughly 2.5 times as large of a category in 2010, and today sells only 1.2 times as many copies of Android books to Developers. Again, this is developer books, not consumer-oriented titles. For more on how the mobile developer market is shaping up, it seems like a two horse race with iOS and Android. Windows Mobile is a blip along with cross-platform solutions like PhoneGap as you can see in the image directly below.

This chart shows the number of units (sum of Unit in blue bars) and the Average units per title (AvgUnitsTitle in red line) for the mobile area. Android has a higher unit average whereas iOS has more units sold because more titles made the list. This all makes me wonder about the Windows Mobile blip and whether Microsoft should just jump into the Android space too or continue to make more from licensing it than their own platform.

Here are the trend lines for the 12 categories that make up Systems and Programming.

Next up, Post 3 will be about the publishers, winners and losers. Post 4 will contain more analysis of programming languages. And Post 5 will look at digital sales.

State of the Computer Book Market 2011 — All five parts of Mike Hendrickson’s computer book market report are collected in this free ebook. Available in EPUB, Mobi and PDF formats.

State of the Computer Book Market 2011 — All five parts of Mike Hendrickson’s computer book market report are collected in this free ebook. Available in EPUB, Mobi and PDF formats.