Startup Centers

Paul Graham recently wrote a couple of thought-provoking essays on the social and economic conditions that are most conducive to the formation of startup companies, How to Be Silicon Valley and Why Startups Condense in America.

Paul had sent one version of these essays to me for comment before publication, but unfortunately, I wasn't able to send in a response in time to be useful. However, Paul also sent me a followup question in email, for which our research group just happens to have some good answers. Paul wrote: "In your opinion, which US cities are the biggest startup centers after Silicon Valley and Boston? Fred Wilson is trying to convince me NYC is no 3, and I just can't believe it. Surely Austin and Seattle have more startups, no?"

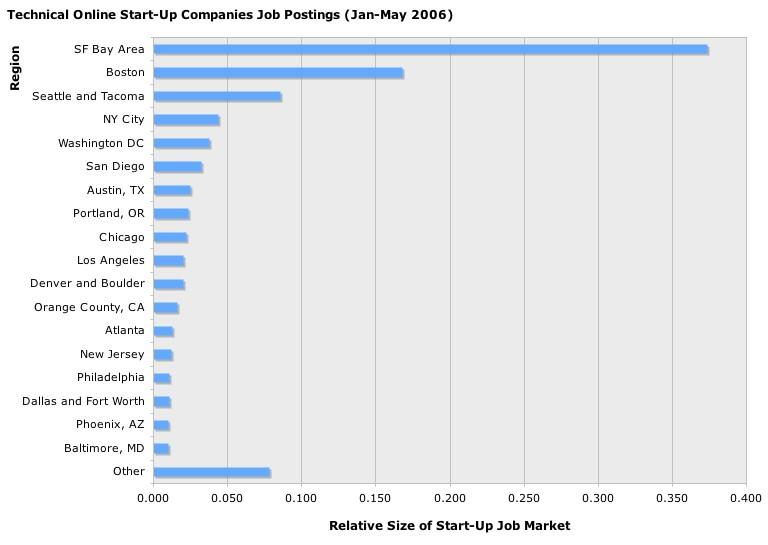

Paul is right, according to Roger Magoulas, the head of O'Reilly Research. The San Francisco Bay Area (including Silicon Valley) is #1, followed by Boston at #2, Seattle/Tacoma at #3, and New York at #4. Paul's wrong about Austin, though. It's at #7, behind Washington D.C. and San Diego. Portland, Chicago, and Los Angeles round out the top ten. Here's Roger's graph showing the relative concentration of tech startups, based on online job listings.

As noted in previous blog posts, the O'Reilly Research data mart includes over fifty-one million job postings acquired through a data sharing agreement with SimplyHired. (See MySQL and the Database Job Market for another example of analysis based on this data.) Roger and his chief analyst, Ben Lorica, took a look at online job postings from January to May 2006. We used a de-duped subset of approximately 2.1 million job listings with reliable geo data for this study.

Roger describes the methodology as follows: "Start-ups were identified using regular expressions to match variants of 'start up' in the job posts. The data includes a small percentage of job posting that are not start-ups, [but] key phrase analysis showed less than .4% of start-up jobs were likely misidentified. We assume errors are randomly distributed in the data. Manual review of random sample passed the 'smell test', i.e., the job postings were for self-defined start-ups, based on job posting content and web site lookup. The methodology will miss start-ups that don't self-identify themselves as start-ups in their job postings."

Roger noted a couple of caveats:

- "Companies posting jobs on-line are past the 'hire all your friends' stage; our analysis covers [only] these more established and better funded start-ups

- Some large metro areas appear underrepresented in the geotagged jobs data. For example, Craigslist, one of the more reliable sources of geotagged job data, has primary sites in the following citites: San Francisco Bay Area, New York City, Boston, Seattle, San Diego, Portland, Chicago, Denver, Los Angeles, Washington DC. Dallas and Houston, the #5 and #7 metro areas in the US show few jobs on CraigsList..

- We performed two roll-ups, one exclusively for technical positions, the other excluding roles not deemed start-up appropriate, e.g., government, education, non-profit, retail. The exclusively technical jobs subset excludes 12.5% of all start-ups in the study. The inappropriate job role subset excludes 9% of all start-ups in the study."

Roger concluded: "One can quibble with aspects of our methodology, but I believe it fairly represents start-up hiring activity by region and that our methodology doesn't introduce any biases not already inherent in the underlying data. Ranks and scale are mostly reliable, i.e., San Francisco and Boston have more start-up job hiring activity than Seattle or New York City; Denver and Boulder results are close enough to Austin that they are equivalent."

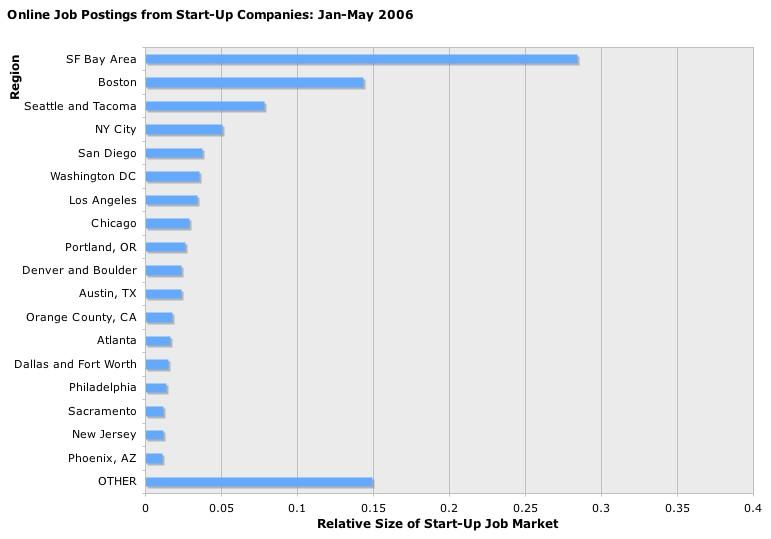

Here's the graph for the second roll-up, which includes non-technical jobs:

To me, this graph suggests a fourth caveat. It seems to me unlikely that San Francisco has a higher rate of small business creation overall than New York, so my guess is that there is significant bias in the non-technical jobs study due to language. Far fewer companies outside of tech may refer to a new business as a "startup." (That is, no one refers to a "start up dry cleaning business.")

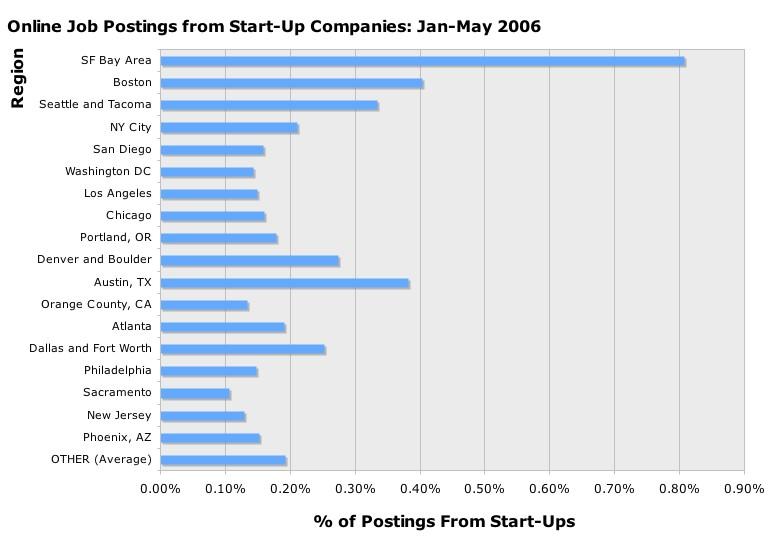

Finally, Roger and Ben also provided a graph showing what share of all jobs in each metro area were start-ups. He wrote: "Now we see that San Francisco, Boston, Austin and Seattle have the highest share of start-up on-line job postings." So based on share of job postings, Austin makes the #3 spot. So it looks like Paul can win his bet with Fred using either Seattle or Austin after all! Here's that final graph:

tags:

| comments: 19

| Sphere It

submit: ![]()

![]()

![]()

![]()

0 TrackBacks

TrackBack URL for this entry: http://blogs.oreilly.com/cgi-bin/mt/mt-t.cgi/4719

Comments: 19

Austin? Hmm. You might be able to suggest statistically that Austin has start up activity, but it certainly doesn't feel that way on the ground. Or if there is, it's in areas this site doesn't generally cover: unsexy hardware stuff, tedious IT plumbing, or power supply makers. There's little community around software startups, and effectively none of the young, exciting kind that gets press on Radar.

The last graph means one thing: a lot of wishful thinking on the part of unfunded startups (i.e. a guy with an idea sitting in front of a computer) and I bet it includes Craigslist job ads which are FREE to post for Austin. So much for nomralization. I would definitely ignore the last one. I've lived in Austin and I currently live in Boston. Major difference. The first and second graphs make a ton of sense.

It's common knowledge that SF has the highest concentration. But too bad the stats don't include less researched cities like Toronto. I've always wondered how they compare to New York and Boston.

Marc

If Seattle and Tacoma are combined as well as Denver and Boulder, I have to wonder why LA and Orange County are listed separately.

I'll echo Marc and say I'd love to see the data for Toronto, Ottawa, and Vancouver added into the soup.

--Dethe

What is meant by NYC?

Is it is referring to Manhattan (that is how New Yorkers refer to it)?

or is it referring to the Five Boroughs - which is officially accurate?

But realistically, it should refer to the New York Metropolitan area as a whole...

this includes Long Island, Westchester and north east New Jersey

The Metro Area as a whole is a Business Mecca - while the biggest concentration is in - very Pricey - Manhattan Boro

Just like the terms Bay area and Seattle and Tacome was used to denote a Business centric community

Tim,

We did a similar analysis and came to different conclusions last month when I was having my initial debate with Paul.

I just posted on this.

http://avc.blogs.com/a_vc/2006/06/ranking_startup.html

Thanks for doing this work and sharing it. This is really interesting data.

Fred

I am a Chicagoan who is now in San Francisco. The difference in startup activitiy is a difference of night and day respectively. If I had my choice I would prefer to live in Chicago far and away, but as far as I can tell, I sense slim pickings for a thriving, collaborative tech community, let alone a startup center mentality. I know there are a few such as 37 Signals and, man, do I applaud them for cropping up where they did, but I just can't wrap my head around why a great city like Chicago with nearby universities of repute and the third largest city (I think) is so behind!! If Paul's reasoning is on the right track, I think I can nominate Chicago for being left behind in the dust as a startup center, and that's a real shame.

I have carried forward the discussion on why Silicon startups do not easily condense in India adding certain reasons that would easily explain the Indian shortcomings at my blog India-IT Pulse: http://india-it-pulse.blogspot.com/2006/06/india-not-conducive-to-silicon.html

I have carried forward the discussion on why Silicon startups do not easily condense in India adding certain reasons that would easily explain the Indian shortcomings at my blog India-IT Pulse: http://india-it-pulse.blogspot.com/2006/06/india-not-conducive-to-silicon.html

Dividing the metro areas we used in the study is a matter of judgement based on population size (we used SMSA - Standard Metropolitan Statistical Area - data available on the web) and geography. We divide LA and Orange because they have large populations and are large geographically. The SMSA data groups Seattle and Tacoma as one metro area and Denver and Boulder as another and we followed that guidance.

A combined Los Angeles and Orange County would tie New York in relative size of start-up job postings.

We should have noted that our data included a mix of paid and free job postings. While free postings do create a bias, Craigslists postings don't cost much, and, no one likes to waste time talking to and recruiting people they can't hire.

While your experience in Austin may not compare to your experience in Boston, the results are affected by Austin's smaller population (Austin SMSA has less than one third the population of the Boston SMSA) and less economic diversity. Anecdotally we consider Austin an area with a history and culture of start-up activity and were not surprised by the results.

We agree Canadian data would be interesting to examine, but we don't have any data at this time. Not only would we be interested in Toronto, but others cities we perceive as having concentrations of technical folks and an entrepreneurial culture like Waterloo and Vancouver. Would also be interesting to study if differences in the social contract (e.g., national health, income distribution) and culture between the US and Canada show up when looking at start-up job posting data.

New York City includes the five boroughs, northern NJ, western Long Island, Westchester and southwestern Connecticut (Fairfield County). As the responder suggests, the biggest concentration is in Manhattan - over 87% of all New York startups and 69% of all jobs in the study period were Manhattan based.

One additional reason that start-up activity varies by region may be attitudes towards risk and failure. In the Bay Area, the entrepreneurial culture and history of booms and busts provides plenty of opportunities to learn from failure. The result, a stint at a failed start-up is perceived less as a black mark and more as a valuable, and common learning experience.

Folks I know in the Bay Area tend to evaluate the career risk of joining a start-up that may fail as secondary to other professional considerations. An attitude I don't see as common in my friends from other parts of the country. From reading, this may be even more true in Western Europe where associating with a failed venture can negatively affect one's career.

Now available, 2005 statistics from today's SF Chronicle. Looks like NY was in 10th place last year.

I think this is a great research article. I am with jobs.gobignetwork.com and we have created the largest hub on the internet for startup company job listings. It's free for job-seekers and charges startups to post their job opportunities. It may be a good resource to make available to your readers.

Tim,

I attended the Boston Social Media Club meeting a few weeks ago, and one of the attendees told me that he or she thought that Boston businesses were not adopting social media as quickly as other regions around the country. Specifically in San Francisco, (not sure if they meant silicon valley) or New York. I told the attendee I was somewhat surprised by their statement because of Boston's 2nd place as a technology and venture capital hub. They assured me that businesses that can afford to pay for social media, maybe the brand marketers are more conservative than their colleagues in New York and SF. I was still doubtful, but started to conduct some research.

There was a recent research report on the social media usage by the Inc 500, while 19% of the Inc 500 is using blogs for instance; only 8-10% of the Fortune 500 appears to be using blogs. Looking into the figures for Boston, NY, and SF, it did appear that Boston had significantly lower social media participation in the Inc 500 compared to NY and SF. Though the sample sizes were really too small.

Okay, sorry about the long intro, but the now I get to the reason I found this excellent article you wrote. I started doing some thinking and research into the Boston technology industry. One discussion that rose from my initial research is how the number of consumer targeted web 2.0 or social media start-ups is smaller in the Boston area compared to silicon valley.

Your research team did some number crunching on the number of jobs in the different metro areas, could they do some research on web 2.0, or social media jobs in each of the metro areas? How does Boston stand in the ranking of cities then?

Oh, any suggestions on how I could measure social media amongst brands in the three different regions would be most helpful as well.

For those who care, this is a new site focused on Texas (Austin, Dallas, Houston) startups and high tech activity: http://www.texastechpulse.com. You can see the graph of recent venture capital fundings in the state here:

http://www.texastechpulse.com/intelligence/map/

Tim, I would be interested in reading a followup post on the current rankings and how the market has changed in the past two years.

Post A Comment:

STAY CONNECTED

RECENT COMMENTS

- Michael R. Bernstein on Startup Centers: Tim, I would be interes...

- Ben on Startup Centers: For those who care, thi...

- John Cass on Startup Centers: Tim, I attended the Bo...

- Eric Corl on Startup Centers: I think this is a great...

- Ben Lorica on Startup Centers: Now available, 2005 sta...

- Roger Magoulas on Startup Centers: One additional reason t...

- Roger Magoulas on Startup Centers: New York City includes ...

- Roger Magoulas on Startup Centers: We should have noted th...

- Roger Magoulas on Startup Centers: Dividing the metro area...

- Vijay on Startup Centers: I have carried forward ...

Paul Martin [06.12.06 08:42 AM]

The last graph suggests an important correction to the analysis: the data should be normalized to the population of the metropolitain area. The last graph does this to some extent, and hence the distribution is quite different.