State of the Computer Book Market, Q306, Part 1, Overall Market Trend

As I try to do each quarter, here's a report on the state of the

computer book market, as revealed by data from Nielsen Bookscan's top

3,000 Computer Books report. (See my entry

Book Sales as a Technology Trend Indicator for a description

of our methodology.)

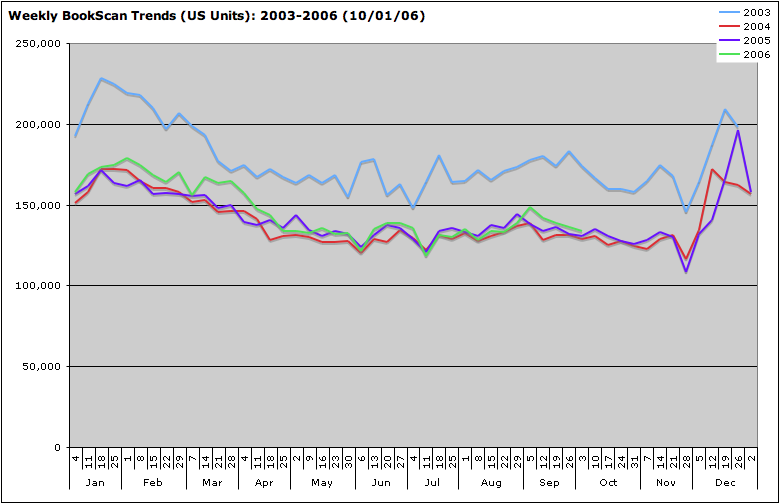

Here's the year-on-year trend since 2003:

There's little to say about this picture that will cheer up computer book publishers or authors. The market continues to bump around at about the same level as it has for the past three years. Some publishers express hope that the release of Microsoft Vista and the next release of Office will boost results going into next year, but so far, no new technology release has been able to move the needle for long. We suspect that the combination of increasingly sophisticated online information, easier to use Web 2.0 applications, and customer fatigue with new features of overly complex applications, combined with the consolidation of the retail book market, mean that the market will never return to its pre-2000 highs, despite new enthusiasm for Web 2.0 and the technology market in general. In addition, new distribution channels (including downloadable PDFs) are growing up as retailers allocate less space to computer books.

That being said, there's no question that Vista, the new release of Microsoft Office (and the next release of Mac OS X) will have a big impact late in the fourth quarter and going into the first quarter of next year.

I continue to be amazed by the regularity of the year-on-year pattern in the data. The calendar trumps new technologies, new books, and the press of world events. Week by week, the same ups and downs seem to recur. December (holiday purchases) and January (exchanges and New Year's resolutions) drive spikes, while July 4 and Thanksgiving create seasonal lows, with other factors driving other recurring bumps and troughs. We like to think we're creatures of choice and will, but any measure of behavior in the aggregate shows how much we respond to the same external triggers.

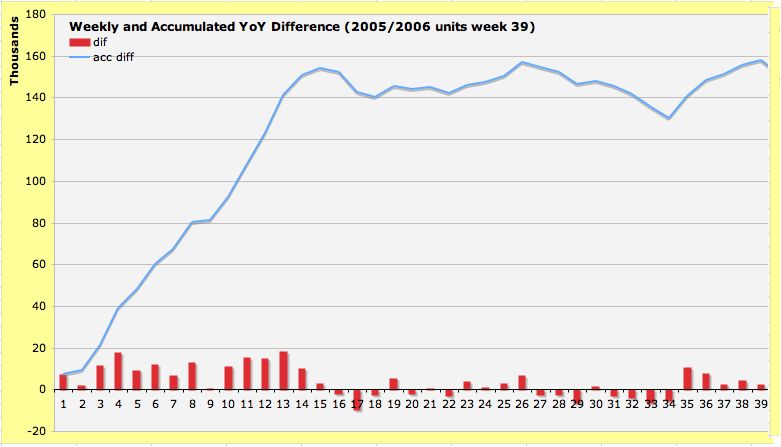

Year on Year Gains Level Off After Q1

As previously reported, the year got off to a strong start, with about 140,000 more units sold in the first quarter than in the first quarter of 2005. Q2 was only up marginally, about 16,000 units above the same quarter in the prior year. Q3 was up only a thousand units. You can see this trend in the figure below, with one line showing the accumulated difference year on year, and the bars at the bottom showing whether each week was above or below the corresponding week in the prior year:

The average price of a computer book increased from $38.02 in 2005 to $38.61 in 2006.

Small Print: Understanding the Numbers

While I've written about this previously, I need to repeat my reminder that Nielsen figures do not represent the entire computer book market. However, they represent a large enough sample to be representative for most categories. Nielsen claims to report 65-70% of US bookstores; the US represents about 70% of the total English-language market. Accordingly, these figures represent perhaps 50% of the total market. I should also remind you that these figures represent sell-through -- that is, books that have actually been sold by bookstores. On royalty statements, publishers report sell-in -- that is, books that have been sold to bookstores, but which may be returned after sitting on the shelves for a while.

Further, revenue figures shown in these reports are calculated based on unit sales times retail price of each book. However, because books are typically sold at a discount of more than 50% to retailers, while Nielsen is reporting on only 50% of the market, these two figures offset each other, and we've found that the resulting revenue figures are within spitting distance of actual publisher and total market figures.

Next up: Details on winners and losers by category.

tags: hard numbers

| comments: 1

| Sphere It

submit: ![]()

![]()

![]()

![]()

0 TrackBacks

TrackBack URL for this entry: http://blogs.oreilly.com/cgi-bin/mt/mt-t.cgi/5013

Comments: 1

Post A Comment:

STAY CONNECTED

RECENT COMMENTS

- Kevin Farnham on State of the Computer Book Market, Q306, Part 1, Overall Market Trend: The first thing I did ...

Kevin Farnham [10.31.06 10:39 PM]

The first thing I did was to click on the graph to enlarge it, and what stood out was the almost eerie pattern matching that is evident in the figures for the past three years, especially in the April to October period. What's essentially happened is that the "noise" level has declined significantly, the market has settled into an unusually stable state, where current performance can be predicted based on past performance with unusual accuracy.

When lulls of this type occur in the stock market, it's often a sign that some large lurch is on the horizon, in one direction or the other. But the timing of the lurch is unpredictable.

It seems to me we are beginning to see the underpinnings of "volatility" in the overall technology market, with some people saying "it feels like the late 1990s" -- either experiencing good times or worried that we're heading into another collapse. My guess is that the technology market is entering a long-term expansion that was "predicted" in the late 1990s, but which will be sustained into the end of this decade because this time the entire world is joining in. With the NASDAQ at 47% of its peak level, I don't know why people talk as though the U.S. technology market has re-entered "bubble" mode.

But if technology is entering a major growth phase, helped along in part by the new-found interest among the wealthy to invest in start-ups, does that mean the computer book publishing industry will rise out of its own doldrums? Only if books are a critical resource in fueling the technology expansion.

I myself like using books, both for learning and as references. I use the Web a lot too, but I still like books. But what technology resources do 25-30 year old engineers seek when then have a problem to solve or a new realm of technology they must quickly learn? Do they look for a book titled "Learn X in 24 Hours" or "X in a Nutshell"? Will they do so in the future?

But, getting back to my original observation, of the almost eerieness of the replication of sales--the situation of a nearby economic world experiencing rapid development (global technology), while a related market (computer book sales) remains unperturbed, almost oblivious to the surrounding volatility, typically doesn't last too too long. I'll be quite surprised if the 2007 data tracks 2004-06 book sales.