- Classic Programmer Paintings — hilarity has ensued. The captions are brilliant.

- Equality Takes Work — Women do not prefer saying less: They anticipate the treatment they will receive when they say more.

- Bitcoin as Politics: Distributed Right-Wing Extremism — The lack of any thorough, non-conspiratorial analysis of existing financial systems means that bitcoin fails to embody any true alternative to them. The reasons for this have little to do with technology and everything to do with the existing systems in which bitcoin and all other cryptocurrencies are embedded, systems that instantiate the forms of social power that cannot be eliminated through either wishful thinking or technical or even political evasion: the rich and powerful will not become poor and powerless simply because other people decide to operate alternate economies of exchange. […] Because it operates without such an account, bitcoin’s real utility and purpose (and that of the cryptocurrency movement in general) can be better understood as a “program” for recruiting uninformed citizens into a neoliberal anti-government politics, understanding the nature and effects of which requires just the attention to political theory and history that bitcoin enthusiasts rail against. So … not a fan, then?

- Raising Robotic Natives — design/art artefacts for generations growing up with robots.

"cryptocurrency" entries

Four short links: 18 April 2016

Classic Programmer Paintings, Equality at Work, Bitcoin as Politics, and Raising Robotic Natives

Four short links: 5 April 2016

Programming Living Cells, Internet of Bricked Discontinued Things, Bitcoin User ID, and Paper-a-Day Roundup

- cello — home page for the Verilogish programming language to design computational circuits in living cells.

- Internet of Bricked Discontinued Things (BusinessInsider) — Shutting down Revolv does not mean that Nest is ceasing to support its products, leaving them vulnerable to bugs and other unpatched issues. It means that the $300 devices and accompanying apps will stop working completely.

- Bitcoin Users Reveal More Than They Think — new technologies trace BTC transactions, attempting to identify bitcoin users. A number of startups have raised money to explore these new possibilities

- Last Three Months of Paper-a-Day (Adrian Colyer) — a pointer to the highlights from the 68 papers he covered in the first three months of the year.

Four short links: January 15, 2016

Bitcoin Resolution, Malware Analysis, Website Screw-Ups, and Dronecode.

- The Resolution of the Bitcoin Experiment — If you had never heard about Bitcoin before, would you care about a payments network that: Couldn’t move your existing money; Had wildly unpredictable fees that were high and rising fast; Allowed buyers to take back payments they’d made after walking out of shops, by simply pressing a button (if you aren’t aware of this “feature” that’s because Bitcoin was only just changed to allow it); Is suffering large backlogs and flaky payments; … which is controlled by China; … and in which the companies and people building it were in open civil war?

- Malware Analysis Repository — the materials as developed and used by RPISEC to teach Malware Analysis at Rensselaer Polytechnic Institute in Fall 2015.

- How Websites Screw Up Experiences (Troy Hunt) — they’re mostly signs of a to-the-death business model.

- Dronecode Moves Forward — Linux Foundation’s Dronecode project has 51 members, is used commercially, and has technical working groups looking at camera and gimbal controls; airspace management; and hardware/software interfaces.

Four short links: 28 December 2015

Bitcoin Software Choke, IoT Chokes, Dynabook History, and Fault Tree Analysis

- Core Bitcoin Devs Leave — According to a press release put out by Company 0 LLC, formed by former bitcoin developers, there are a few external entities that fund the actual development of the bitcoin cryptocurrency, forming a power-group that is in sole command of the direction the currency takes. These developers say that this group limits outside input in the currency’s governance, cherry-picks only options favorable for their own interests, and generally ignores the developers’ and community’s best interests.

- Internet of Proprietary Things — wonderfully accessible list of things we don’t have: Because companies can enforce anti-competitive behavior this way, there’s a litany of things that just don’t exist, even though they would make life easier for consumers in significant ways. You can’t have custom software for your cochlear implant, or your programmable thermostat, or your computer-enabled Barbie doll. An auto-repair shop can’t design a better diagnostic system that interfaces with a car’s computers. Capturing all the value you create, versus creating more value than you capture.

- Tracing the Dynabook — a historical study of the Dynabook project and vision, which began as a blue-sky project to define personal and educational computing at Xerox PARC in the 1970s. It traces the idea through the three intervening decades, noting the transformations that occur as the vision and its artifacts meet varying contexts. (via Bret Victor)

- Fault Tree Analysis (FTA): Concepts and Applications (PDF) — 194 slides from NASA. (via Mara Tam)

Four short links: 22 December 2015

Machine Poetry, Robo Script Kiddies, Big Data of Love, and Virtual Currency and the Nation State

- How Machines Write Poetry — Harmon would love to have writers or other experts judge FIGURE8’s work, too. Her online subjects tended to rate the similes better if they were obvious. “The snow continued like a heavy rain” got high scores, for example, even though Harmon thought this was quite a bad effort on FIGURE8’s part. She preferred “the snow falls like a dead cat,” which got only middling ratings from humans. “They might have been cat lovers,” she says. FIGURE8 (PDF) system generates figurative language.

- The Decisions the Pentagon Wants to Leave to Robots — “You cannot have a human operator operating at human speed fighting back at determined cyber tech,” Work said. “You are going to need have a learning machine that does that.” I for one welcome our new robot script kiddie overlords.

- Love in the Age of Big Data — Over decades, John has observed more than 3,000 couples longitudinally, discovering patterns of argument and subtle behaviors that can predict whether a couple would be happily partnered years later or unhappy or divorced. Turns out, “don’t be a jerk” is good advice for marriages, too. (via Cory Doctorow)

- National Security Implications of Virtual Currency (PDF) — Rand research report examining the potential for non-state actor deployment.

Our future sits at the intersection of artificial intelligence and blockchain

The O'Reilly Radar Podcast: Steve Omohundro on AI, cryptocurrencies, and ensuring a safe future for humanity.

Subscribe to the O’Reilly Radar Podcast to track the technologies and people that will shape our world in the years to come.

I met up with Possibility Research president Steve Omohundro at our Bitcoin & the Blockchain Radar Summit to talk about an interesting intersection: artificial intelligence (AI) and blockchain/cryptocurrency technologies. This Radar Podcast episode features our discussion about the role cryptocurrency and blockchain technologies will play in the future of AI, Omohundro’s Self Aware Systems project that aims to ensure intelligent technologies are beneficial for humanity, and his work on the Pebble cryptocurrency.

Synthesizing AI and crypto-technologies

Bitcoin piqued Omohundro’s interest from the very start, but his excitement built as he started realizing the disruptive potential of the technology beyond currency — especially the potential for smart contracts. He began seeing ways the technology will intersect with artificial intelligence, the area of focus for much of his work:

I’m very excited about what’s happening with the cryptocurrencies, particularly Ethereum. I would say Ethereum is the most advanced of the smart contracting ideas, and there’s just a flurry of insights, and people are coming up every week with, ‘Oh we could use it to do this.’ We could have totally autonomous corporations running on the blockchain that copy what Uber does, but much more cheaply. It’s like, ‘Whoa what would that do?’

I think we’re in a period of exploration and excitement in that field, and it’s going to merge with the AI systems because programs running on the blockchain have to connect to the real world. You need to have sensors and actuators that are intelligent, have knowledge about the world, in order to integrate them with the smart contracts on the blockchain. I see a synthesis of AI and cryptocurrencies and crypto-technologies and smart contracts. I see them all coming together in the next couple of years.

Better currency through programming

The O'Reilly Radar Podcast: Vitalik Buterin on bitcoin, the blockchain, Ethereum, and the future of money.

In this Radar Podcast, I chat with Vitalik Buterin, founder of Ethereum and co-founder of Bitcoin Magazine. We met at our Bitcoin & the Blockchain summit in San Francisco to talk about the disruptive potential of the bitcoin and blockchain technologies. He also outlined some of the problems he’s trying to solve with Ethereum and weighed in on how the use cases of money are going to change over the next 10 to 20 years.

Buterin told me that his father initially introduced him to bitcoin in 2011, and he wasn’t immediately interested — in fact, he outright rejected it, thinking, “It looks like it has no intrinsic value, and it’s obviously not going to work.” As he kept hearing about, he decided to investigate more and came to the realization that ultimately led him to create the Ethereum platform:

I immediately recognized that the way bitcoin works is the way that money should work. It’s exactly the correct approach, where you have: here’s the address you’re supposed to send to, here’s how much you want to send, here’s the button to send it. It’s money made for the Internet, not like the credit card approach, where you just basically give everyone the details to take as much as they want from your bank account.

On a trip to Israel, Buterin encountered projects, such as Colored Coins and Mastercoin, using blockchain technology for things other than bitcoin currency. “They were trying to let people issue their own assets,” he said. “They were trying tack features on top, tack financial contracts on top.” The protocols, Buterin noted, were overly complicated and he realized there might be a better way: “You could make it much simpler just by replacing everything with a programming language, and then if you do that, then people can write as many features as they want in the programming language after the fact.”

Security comes from evolution, not revolution

The O'Reilly Radar Podcast: Mike Belshe on making bitcoin secure and easy enough for the mainstream.

Editor’s note: you can subscribe to the O’Reilly Radar Podcast through iTunes, SoundCloud, or directly through our podcast’s RSS feed.

In this week’s O’Reilly Radar Podcast episode, I caught up with Mike Belshe, CTO and co-founder of BitGo, a company that has developed a multi-signature wallet that works with bitcoin. Belshe talks about about the security issues addressed by multi-signature wallets, how the technology works, and the challenges in bringing cryptocurrencies mainstream. We also talk about his journey into the bitcoin world, and he chimes in on what money will look like in the future. Belshe will address the topics of security and multi-signature technology at our upcoming Bitcoin & the Blockchain Radar Summit on January 27, 2015, in San Francisco — for more on the program and registration information, visit our Bitcoin & the Blockchain website.

Multi-signature technology is exactly what it sounds like: instead of authorizing bitcoin transactions with a single signature and a single key (the traditional method), it requires multiple signatures and/or multiple machines — and any combination thereof. The concept initially was developed as a solution for malware. Belshe explains:

“I’m fully convinced that the folks who have been writing various types of malware that steal fairly trivial identity information — logins and passwords that they sell super cheap — they are retooling their viruses, their scanners, their key loggers for bitcoin. We’ve seen evidence of that over the last 12 months, for sure. Without multi-signature, if you do a bitcoin transaction on a machine that’s got any of this bad stuff on it, you’re pretty much toast. Multi-signature was my hope to fix that. What we do is make one signature happen on the server machine, one signature happen on the client machine, your home machine. That way the attacker has to actually compromise two totally different systems in order to steal your bitcoin. That’s what multi-signature is about.”

Clustering bitcoin accounts using heuristics

In this O'Reilly Data Show Podcast: Sarah Meiklejohn on analytic applications for blockchain and cryptocurrency technology.

Editor’s note: we’ll explore present and future applications of cryptocurrency and blockchain technologies at our upcoming Radar Summit: Bitcoin & the Blockchain on Jan. 27, 2015, in San Francisco.

A few data scientists are starting to play around with cryptocurrency data, and as bitcoin and related technologies start gaining traction, I expect more to wade in. As the space matures, there will be many interesting applications based on analytics over the transaction data produced by these technologies. The blockchain — the distributed ledger that contains all bitcoin transactions — is publicly available, and the underlying data set is of modest size. Data scientists can work with this data once it’s loaded into familiar data structures, but producing insights requires some domain knowledge and expertise.

Subscribe to the O’Reilly Data Show Podcast

I recently spoke with Sarah Meiklejohn, a lecturer at UCL, and an expert on computer security and cryptocurrencies. She was part of an academic research team that studied pseudo-anonymity (“pseudonymity”) in bitcoin. In particular, they used transaction data to compare “potential” anonymity to the “actual” anonymity achieved by users. A bitcoin user can use many different public keys, but careful research led to a few heuristics that allowed them to cluster addresses belonging to the same user:

“In theory, a user can go by many different pseudonyms. If that user is careful and keeps the activity of those different pseudonyms separate, completely distinct from one another, then they can really maintain a level of, maybe not anonymity, but again, cryptographically it’s called pseudo-anonymity. So, if they are a legitimate businessman on the one hand, they can use a certain set of pseudonyms for that activity, and then if they are dealing drugs on Silk Road, they might use a completely different set of pseudonyms for that, and you wouldn’t be able to tell that that’s the same user.

Clearing up a few of bitcoin’s misconceptions

Bitcoin is more than just a currency. Here’s a look at what it is and what it isn’t.

Just what is bitcoin, anyway?

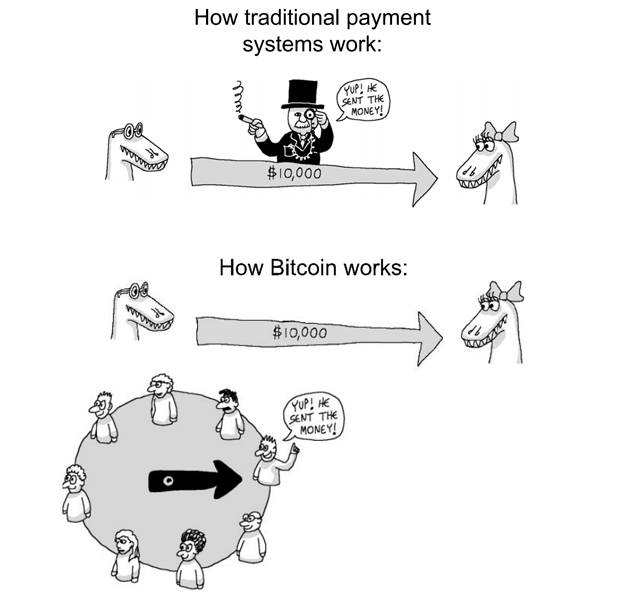

Conrad Barski and Chris Wilmer, authors of Bitcoin for the Befuddled, recently hosted a webcast discussing exactly what bitcoin is (and what it isn’t), how it’s used, how businesses can use it, and some of the disruptive opportunities that bitcoin offers entrepreneurs.

They presented an overview that clears up some of the misconceptions about bitcoin. Read more…