"decentralization" entries

Regulation and decentralization: Defending the blockchain

Andreas Antonopoulos urges the Canadian Senate to resist the temptation to centralize bitcoin.

Editor’s note: our O’Reilly Radar Summit: Bitcoin & the Blockchain will take place on January 27, 2015, at Fort Mason in San Francisco. Andreas Antonopoulos, Vitalik Buterin, Naval Ravikant, and Bill Janeway are but a few of the confirmed speakers for the event. Learn more about the event and reserve your ticket here.

We recently announced a Radar summit on present and future applications of cryptocurrencies and blockchain technologies. In a webcast presentation one of our program chairs, Kieren James-Lubin, observed that we’re very much in the early days of these technologies. He also noted that the technologies are complex enough that most users will rely on service providers (like wallets) to securely store, transfer, and receive cryptocurrencies.

As some of these service providers reach a certain scale, they will start coming under the scrutiny of regulators. Certain tenets are likely to remain: currencies require continuous liquidity and large financial institutions need access to the lender of last resort.

There are also cultural norms that take time to change. Take the example of notaries, whose services seem amenable to being replaced by blockchain technologies. Such a wholesale change would entail adjusting rules and norms across localities, which means going up against the lobbying efforts of established incumbents.

One way to sway regulators and skeptics is to point out that the decentralized nature of the (bitcoin) blockchain can unlock innovation in financial services and other industries. Mastering Bitcoin author Andreas Antonopoulos did a masterful job highlighting this in his recent testimony before the Canadian Senate:

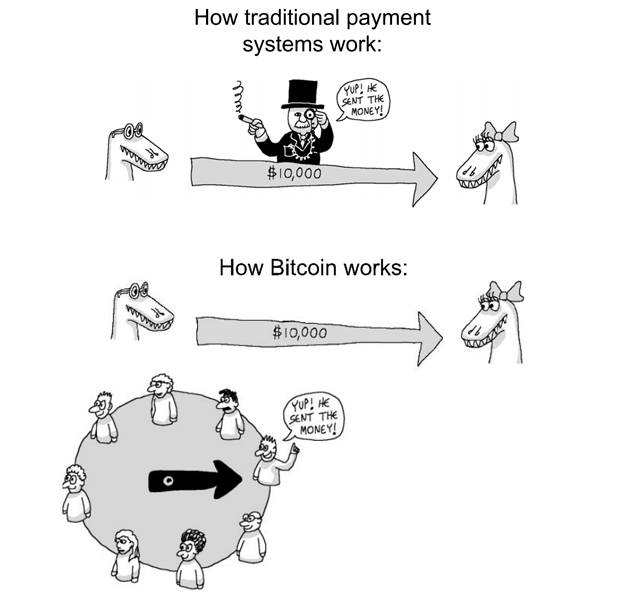

“Traditional models for financial payment networks and banking rely on centralized control in order to provide security. The architecture of a traditional financial network is built around a central authority, such as a clearinghouse. As a result, security and authority have to be vested in that central actor. The resulting security model looks like a series of concentric circles with very limited access to the center and increasing access as we move farther away from the center. However, even the most outermost circle cannot afford open access.

Clearing up a few of bitcoin’s misconceptions

Bitcoin is more than just a currency. Here’s a look at what it is and what it isn’t.

Just what is bitcoin, anyway?

Conrad Barski and Chris Wilmer, authors of Bitcoin for the Befuddled, recently hosted a webcast discussing exactly what bitcoin is (and what it isn’t), how it’s used, how businesses can use it, and some of the disruptive opportunities that bitcoin offers entrepreneurs.

They presented an overview that clears up some of the misconceptions about bitcoin. Read more…

Blockchain and decentralization hold big implications for society

Chris Clark on the blockchain's potential to disrupt the financial industry, from contracts to mortgages to government taxation.

Bitcoin has come a long way from initially being perceived as a pipe dream or fake money. In a recent interview, Chris Clark, a software developer, entrepreneur, physicist, and author of Bitcoin Internals, recalled a story of one of the first bitcoin transactions: someone was congratulated on their “free pizza” after paying in the neighborhood of 10,000 bitcoins for two pizzas. “Now that would be worth, I don’t know, like millions of dollars,” noted Clark.

While Clark said he regrets not getting involved in bitcoin back in 2010-2011, when “bitcoins were super cheap,” he has since researched and written a technical guide to bitcoin, Bitcoin Internals, and expanded his research into the blockchain, looking at the value of blockchain technology for businesses and the potential impacts of decentralization. In our conversation, he described the early evolution direction:

“Right now, we can see that people are kind of looking at bitcoin mostly as just a regular payment system. While I do think that’s definitely a very important innovation, what we’re seeing is a lot of new technologies coming out that are more about things like smart contracts and decentralized organizations, which are right now really in their infancy. I think that those are actually going to be much bigger in overall impact than the payment system itself.”

Decoding bitcoin and the blockchain

Introducing Bitcoin & the Blockchain: An O’Reilly Radar Summit

When the creators of bitcoin solved the “double spend” problem in a decentralized manner, they introduced techniques that have implications far beyond digital currency. Our newly announced one-day event — Bitcoin & the Blockchain: An O’Reilly Radar Summit — is in line with our tradition of highlighting applications of developments in computer science. Financial services have long relied on centralized solutions, so in many ways, products from this sector have become canonical examples of the developments we plan to cover over the next few months. But many problems that require an intermediary are being reexamined with techniques developed for bitcoin.

How do you get multiple parties in a transaction to trust each other without an intermediary? In the case of a digital currency like bitcoin, decentralization means reaching consensus over an insecure network. As Mastering Bitcoin author Andreas Antonopoulos noted in an earlier post, several innovations lie at the heart of what makes bitcoin disruptive:

“Bitcoin is a combination of several innovations, arranged in a novel way: a peer-to-peer network, a proof-of-work algorithm, a distributed timestamped accounting ledger, and an elliptic-curve cryptography and key infrastructure. Each of these parts is novel on its own, but the combination and specific arrangement was revolutionary for its time and is beginning to show up in more innovations outside bitcoin itself.”

Bitcoin’s road to democratization lies in decentralization

Conrad Barski on the bitcoin and blockchain landscape and how the technology will evolve over the next 10 years.

Conrad Barski, a medical doctor, a cartoonist, programmer, and author of Land of Lisp, has been experimenting with bitcoin since 2011. In a recent interview, Barski talked about the bitcoin and blockchain landscape and noted the potential of decentralization:

“We’re heading into a world where things are becoming more decentralized. Most people already appreciate that because we all know about things like Airbnb and Uber. Of course, there’s kind of a paradox there because we think of Airbnb and Uber as being decentralized, but of course they’re these very centralized companies that run things…I think 10 years from now we’re going to see that these types of semi-decentralized companies are going to be replaced by fully decentralized companies, where the company itself just runs in an automated way on some kind of cryptocurrency. No one knows what cryptocurrency that will be, but there are folks from Ripple, from Counterparty, from Ethereum all trying to build an infrastructure that essentially let’s you run a company that isn’t controlled by any individual person. I think that’s really in the long term the most exciting part about bitcoin.”

What about bitcoin as a currency? In the short term, it’s an open question, said Barski, but he predicted an expansion similar to what we’ve seen with BitTorrent: