If you haven’t noticed, creating and executing mobile platform plays is really hard. Just ask HP, RIM, Nokia and Microsoft.

If you haven’t noticed, creating and executing mobile platform plays is really hard. Just ask HP, RIM, Nokia and Microsoft.

Even Google’s Android, which made it look easy to grab dominant market share in the smartphone market, is finding it much harder to secure a footprint in the tablet market, where, let’s face it, there’s iPad … and iPad.

Enter Amazon, whose forthcoming Kindle Tablet represents the clearest alternative to Apple’s iPad.

Securing the design win

I once co-founded a device management platform company in the embedded systems space (Rapid Logic) where we came to define three core precepts for succeeding in a platform-oriented business:

- Secure the design win.

- Grow the dollars associated with the runtime (via royalties or new product add-ons).

- Get the customer to want to embed themselves more deeply.

Flash forward to the present and we see a post-PC device market emerging that has revealed some interesting attributes.

For one, we see how the carrier-dependent mobile phone segment logically bifurcates between the Apple approach (vertical integration) and the Android approach (horizontal, loose coupling).

Why is this so? For the simple reason that for a large portion of the market, carrier “push” via phone pricing — plus a subsidy combined with a retail presence — dictates buying patterns every bit as much as product positioning and differentiation.

Most fundamentally, this is because regardless of whether the end phone is an iPhone or an Android phone, A) the buyer is already a mobile phone subscriber, and B) either phone represents a step up from traditional feature phones.

However, when we move into tablet-style devices, ebook and media device players, where the alternative is non-consumption (i.e., buying no device), it becomes clear that the breadth and depth of ecosystem orchestration that is required goes up materially.

This is why Android has not yet found a foothold in the tablet market (see also: Android’s Missing Leg).

Cloud Street meets Main Street

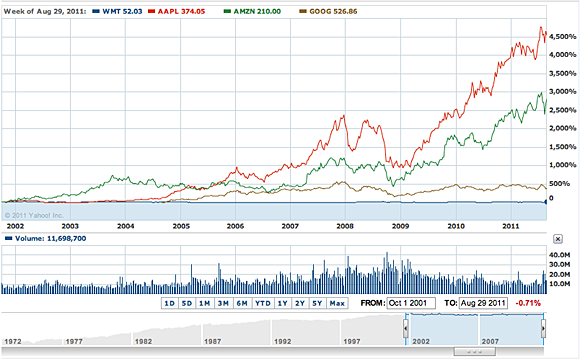

Now, consider Amazon, the ecommerce company that many have officially anointed as this generation’s Walmart (see chart below: Walmart, Amazon, Google and Apple head-to-head over the past 10 years).

A comparison of Walmart, Amazon, Google and Apple from October, 2001 to August, 2011. See a larger version and read related analysis.

Amazon, in fact, just experienced its fastest revenue growth quarter in over a decade (up 51% versus the same period in 2010). It is unquestionably on a roll.

To establish the scale and market presence that Amazon has on “Cloud Street” in about one-third of the time it took for Walmart to dominate “Main Street” is nothing short of amazing.

Simply put, it’s emblematic of a company whose ability to marry a clear, disciplined strategy with a pragmatic focus on tactical execution knows few bounds.

Kindle as an entry point for a new tablet design

Amazon’s Kindle reading device has catapulted the company into a position where it’s now selling more digital books than print books, all at a time when the physical bookstore is on its last legs (Borders is gone, Barnes & Noble is for sale).

Now, having proven that it can execute a hardware-software-service play vis-à-vis the Kindle, Amazon is expected to announce its first iPad competitor in a matter of days.

Such a device will build upon several “unfair advantages” that Amazon has established in the marketplace:

- Ecommerce and marketplace logistics.

- Digital media content acquisition, publishing and distribution.

- Cloud computing platform know-how and a nascent ecosystem.

Just as Apple has leveraged its iTunes as the wedge upon which it established a billing relationship with 160 million users, Amazon has built a differentiated position of its own called Amazon Prime.

Amazon’s “Prime Directive”

Returning to the start of the article, remember the success mantra that I told you about for my company? You can apply the same logic when looking at how Amazon matches up to Apple.

Returning to the start of the article, remember the success mantra that I told you about for my company? You can apply the same logic when looking at how Amazon matches up to Apple.

Apple’s initial innovation with iTunes was that it afforded consumers the ability to purchase music à la carte — one single at a time — when up until that point it could only be purchased in record or CD form. Coupled with a $0.99 per song pricing model and the unparalleled convenience of click-buy-play, this was a recipe to change the way that customers bought and experienced music.

Similarly, Amazon’s initial innovation with Amazon.com was that it enabled people to discover, purchase and transparently receive a seemingly bottomless wellspring of books, where formerly you pretty much only got what was on the shelves in the bookstore.

Like Apple, Amazon used a disruptive pricing and logistics model to entice customers to change their buying behavior.

That Apple has expanded iTunes into an App Store (and iBooks) and a family of devices bound by a common software platform, and Amazon has expanded its catalog to products and services of all stripes (analog and digital), makes perfect sense in this context.

From the initial “design win” of music buying and book buying, both companies have grown the categories and aggregate dollars of their bases in ways that have made consumers want to be more deeply embedded in their relationships with Apple and Amazon.

The Amazon Prime product has cultivated a base of an estimated five million subscribers (from the company’s aggregate base of 120 million customers) that, in exchange for an annual $79 fee, provides expedited shipping on many products.

Why is this a big deal? The friction-free model is enticing some customers to use Amazon for product purchases (e.g., bulk goods, toiletries) that historically have been the parlance of the local Walgreens or Costco.

So, if MG Siegler of TechCrunch is correct in his excellent scoop on Amazon’s Kindle Tablet, then Amazon will be bundling Amazon Prime with its forthcoming 7-inch tablet device and pricing the device at a disruptively low price point of $250 — about half the cost of an entry-level iPad.

If you create a superset between Kindle buyers and Prime subscribers, a logical early-adopter user base emerges for Amazon to target for its iPad alternative (in terms of price, footprint and aggregate value proposition).

Plus, from a strategic leverage perspective, it makes total sense. Amazon, after all, is first and foremost a great retailer.

Add on to this value proposition the fact that Amazon has surrounded its Prime offering with an ever-growing free library of bundled video content (i.e., a poor man’s Netflix streaming service), and the Kindle Tablet starts to feel like a lifestyle device that can succeed over the long haul.

After all, media is a big differentiator on this type of device. And in terms of sheer economics, there are a lot of people these days for whom a bundled video service with a pay-as-you-go library of premium music, books, video and app offerings feels right at $250.

No less, if we know anything about Amazon, it is that it, like Apple, has the fortitude, focus and sense of purpose to see big ideas through to long-term success.

Amazon, after all, wants to be the only shopping cart you’ll ever need, and this becomes another channel back to the consumer.

Plus, from an average revenue per user perspective (ARPU), you can probably subsidize the device a bit more with the Prime subscriber, knowing that Prime customers are already paying $79 a year and are faithful, dedicated, recurrent commerce customers.

Some final thoughts:

Just because Amazon has a logical path to finding a “wedge” in the tablet computing market doesn’t mean that it will. There are hard strategic decisions about how to fork Android and how that ties in with Amazon’s Appstore strategy, including approaches to competing services (e.g., will Amazon allow Nook or iBooks to be installed?).

Moreover, is Amazon prepared to develop and support a software developer’s kit (SDK) and get sucked into a developer tools arms race with Apple?

Similarly, how does Amazon Web Services and Amazon’s cloud platform fold into the equation?

Like I said at the start, mobile platforms are really hard to create and execute, but if anyone is in a position to do just that, it’s Amazon.

Related: