Here’s what caught my attention in the payment space this week.

Apple wants a bigger bite of the publishing pie

Apple announced a subscription plan for publishers through its iTunes store,

a plan that seemed to annoy and confuse publishers while creating a nice opportunity for Google to ride in the next day with a competing plan that publishers seemed to like better.

Apple’s plan goes something like this: If a publisher sells a subscription through the app and the iTunes store, Apple takes 30% and keeps control of the subscriber’s data. Some of the coverage of the plan missed the point that if the publisher brings an existing subscriber over to the App, they keep the revenue and Apple doesn’t get a cut — at least not until that subscriber renews through the app. Publishers were at least as miffed about Apple’s control over the user data. Apple sees these as iTunes subscribers, whose information they will jealously guard. Publishers see them as subscribers whom they need to send endless renewal reminders and whose names they need to sell to other publishers, Omaha Steaks, and the Franklin Mint.

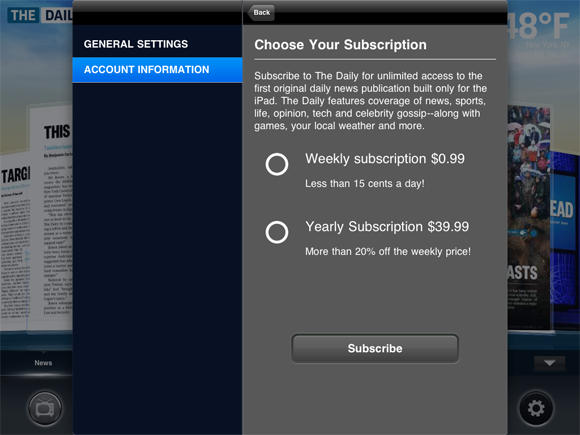

The in-app subscription screen from The Daily

The 10% that Google will collect from publishers who opt to participate in its One Pass program looks mighty good by comparison. Google will sell subscriptions through a yet-to-appear newsstand, process them with Google Checkout, and hand over subscriber data to the publisher. “We don’t prevent you from knowing, if you’re a publisher, who your customers are, like some other people,” The Wall Street Journal quoted CEO Eric Schmidt saying. Subscribers will get a login that lets them read the publication on their phone, tablet, or on the web.

Publishers seemed to welcome the clarity and generosity of Google’s plan, but Matthew Ingram at GigaOm wondered if Google’s One Pass was “pretty much just a warmed-over content paywall” since he doubted the open Android platform could deliver the high-quality user experience that iPad users have been frothing over. There may also be a case to the argument that Apple’s iTunes subscribers are higher value leads: Silicon Alley Insider published this chart based on data from Mobclix suggesting that iPhone app users are worth more to developers (and, presumably, publishers) than Android app users. That’s not much of a stretch. After all, we know they’ve probably paid more for their devices.

Can Isis unite the gods of mobile commerce?

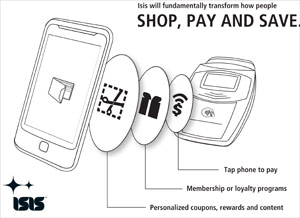

I’ve reported recently on individual efforts to enable tap-and-pay capabilities for mobile phones — Paypal and Bump, for example. And I’ve written several times about Starbucks’ mobile payment app, just because it gives me an excuse to go get coffee. But I’ve also noted that a different app for every checkout would be cumbersome. Mobile telcos think so, too, so they are teaming up around a standard called Isis.

I’ve reported recently on individual efforts to enable tap-and-pay capabilities for mobile phones — Paypal and Bump, for example. And I’ve written several times about Starbucks’ mobile payment app, just because it gives me an excuse to go get coffee. But I’ve also noted that a different app for every checkout would be cumbersome. Mobile telcos think so, too, so they are teaming up around a standard called Isis.

Isis, which was announced last fall, aims to put payment capability inside phones by the spring of 2012. It could work something like this: if the carriers, credit card companies, and banks agree on how the system should work, including where the financial data is stored on the phone (probably the SIM card), how payment happens (NFC wireless communication), how secure it is, how transactions get processed, and who gets a cut, they could work to implement the standard on new phones and configure a backward-compatible bridge to existing devices. AT&T Mobility, Verizon Communications, and T-Mobile USA launched the effort, and they’re tapping the payment expertise of Barclaycard US and Discover Financial Services.

While the combined muscle of these big names gives credence to the effort, it can also be difficult to get too many giants to dance to the same tune. Occasionally, industry-wide standards efforts flounder on the demands and compromises of too many players, and a rogue player undercuts the effort by presenting a viable alternative that becomes a de facto standard. Windows Explorer’s dominance in the early- to mid-2000s and Apple’s music format (AAC with digital rights management) used on iTunes from 2003-2007 are two examples.

Drew Sievers at MFoundry has a perspective on Isis based on experience with an earlier attempt at universal mobile payments called Firethorn. (Qualcomm paid big bucks for the service, but banks balked at letting the carriers control their customers’ purchasing experience.)

In the past there may not have been enough of a platform on which to build consumer acceptance for any payment standard. Now, however, with smartphones exponentially altering what consumers think they can do with their devices, the Isis partners stand a better chance. Of course, as Sievers points out in his post, they’ll have competition as the credit card firms and mobile operating system companies throw their weight behind various competing or collaborative efforts.

Bling Nation wants you to Like them

We can take it as a sign that Bling Nation is “all-in” on social when they set their domain to roll over to their Facebook page.

“We feel strongly that, with 650 million people using Facebook, that’s the place where communication is occurring,” Bling Nation’s general manager Matt Murphy told me. “We wanted to put our whole experience there.”

Bling Nation received a fair amount of attention last year with a contactless payment trial. Murphy said about 30,000 users have tried out the Bling sticker (which contains an NFC chip) on their phones, and they can use it to buy stuff at “thousands” of merchants in the Bay Area. Tapping Bling’s point-of-purchase hardware charges the user’s PayPal account.

Murphy said Bling is counting on the viral nature of Facebook and its users’ relationships to show when they’ve Blinged a purchase or — and this appears to be the key incentive — earned a reward, like a discount on their next cup of coffee or caesar cut. “We’re asking consumers to change their behavior,” he said. “We’ve got to offer them something in return for that.”

Got news?

News tips and suggestions are always welcome, so please send them along.

If you’re interested in learning more about the payment development space, check out PayPal X DevZone, a collaboration between O’Reilly and PayPal.

Related: