Here’s what caught my attention in the payment space this week.

Swipe-and-pay cometh

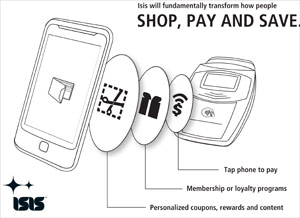

The coming ease of swiping and paying with your smartphone seems like an inevitability at this point, but there was some interesting speculation this week about who would bring it to us first and what the value would be. Forbes columnist Elizabeth Woyke reported that Isis’ CEO Michael Abbott continues to expand the company’s “mobile wallet” program, inviting Apple, Google, and Sprint into the big-tent effort. When Isis was announced last autumn it was a joint venture by telecoms AT&T, Verizon and T-Mobile that was paired with Discover Card and Barclays bank. Since then it’s sought to open up and broaden its base. No word yet from Apple and Google, but their joining the effort seems unlikely since both are pursuing their own NFC solutions.

The coming ease of swiping and paying with your smartphone seems like an inevitability at this point, but there was some interesting speculation this week about who would bring it to us first and what the value would be. Forbes columnist Elizabeth Woyke reported that Isis’ CEO Michael Abbott continues to expand the company’s “mobile wallet” program, inviting Apple, Google, and Sprint into the big-tent effort. When Isis was announced last autumn it was a joint venture by telecoms AT&T, Verizon and T-Mobile that was paired with Discover Card and Barclays bank. Since then it’s sought to open up and broaden its base. No word yet from Apple and Google, but their joining the effort seems unlikely since both are pursuing their own NFC solutions.

Once we gain the ability to swipe and pay with our phones, what will that change? Matthew Talbot, a senior vice president for mCommerce with Sybase365, notes in a blog post this week that the technology to swipe using a credit card has been around for a while, and he wonders how much more convenient swiping with a phone will be:

[T]he convenience factor of tapping a phone versus swiping a card is not significant to change user behavior, so it remains to be seen if NFC is the way forward. In fact the chief benefit of driving payments from handsets accrues to retailers rather than consumers.

And that’s the key driver, in my opinion. While it was difficult to demonstrate value to a merchant of pushing the credit-card-swiping technology, the benefits of connecting with a user’s mobile phone — from identify confirmation to follow-up with text coupons — are a clearer incentive.

This week there are rumors that Apple itself might be one of the first retailers to try to make good on this opportunity. The web is buzzing about secret meetings at Apple’s retail stores and plans for the unveiling of … something. Mashable wondered if it might be a switch from employees selling on iPhones to selling on iPad 2s, while Fast Company speculated that it might be the installation of NFC-capable terminals.

Mobile banking surges (almost) everywhere

Global use of mobile banking grew rapidly over the past year, more than doubling in some key emerging markets like China and Brazil, according to research from TNS. Even in more established markets like the US, UK, Singapore, South Korea, and Sweden, uptake was high, spurred by financial institutions offering mobile banking and improvements by those who were already doing so, the report says. TNS highlighted the prediction that mobile banking will leapfrog current technologies in some emerging markets, just as communications have where many people’s first phones were mobiles:

[I]n more mature markets, mobile banking is simply a matter of convenience, and largely an extension of the PC online experience … however in developing markets mobile may provide an entry point to banking for millions of “unbanked” people, in countries where banking infrastructure is poor, and banking restrictions create barriers.

Uptake in more developed markets is significant, but there’s still plenty of runway out in front, with only about 1 in 5 bank customers in the UK, US, and Sweden using their mobiles to bank.

Uptake in more developed markets is significant, but there’s still plenty of runway out in front, with only about 1 in 5 bank customers in the UK, US, and Sweden using their mobiles to bank.

Banks are doing what they can to innovate in order to encourage them: just a few weeks ago ING Direct became the first to let customers use Bump to transfer money from one customer to another, from one smartphone to another. Both customers have to have an ING Electric Orange account, iPhones, and the but it’s a start.

Not everyone’s happy about the pace. The chief general manager of the Reserve Bank of India (India’s central bank, similar to the US Federal Reserve) suggests that India is a laggard. In remarks this week, G Padmanabhan expressed disappointment at the slow growth of mobile banking in India, even after the RBI had deregulated to allow more mobile banking services. “Implementation of some of the policy directives, which were emanated largely on the demands of stakeholders, has been far from satisfactory,” he said. The remarks are no doubt designed to spur an industry where execution lags ambition, but it’s likely that once mobile banking gains a foothold with at least one major institution, it will build momentum rapidly — as happened with the ATMs.

Got news?

News tips and suggestions are always welcome, so please send them along.

If you’re interested in learning more about the payment development space, check out PayPal X DevZone, a collaboration between O’Reilly and PayPal.

Related: