Here are some things that caught my eye in the news this week.

When will Apple mainstream mobile payments?

Now that everyone’s iPhone 4S has a few dings on it and we’ve all grown bored flirting with Siri, our curiosity naturally turns to iPhone 5 and what gifts it will bequeath on mankind. Rumors of NFC (near-field communication, which lets phones pay with wireless technology), are at the forefront again, just as they were before the 4S arrived. As far back as August 2010, when Apple hired NFC expert Benjamin Vigier as its product manager for mobile commerce, expectations have been high that the next iPhone would include wireless payment. That was two versions ago; we must be getting close.

Now that everyone’s iPhone 4S has a few dings on it and we’ve all grown bored flirting with Siri, our curiosity naturally turns to iPhone 5 and what gifts it will bequeath on mankind. Rumors of NFC (near-field communication, which lets phones pay with wireless technology), are at the forefront again, just as they were before the 4S arrived. As far back as August 2010, when Apple hired NFC expert Benjamin Vigier as its product manager for mobile commerce, expectations have been high that the next iPhone would include wireless payment. That was two versions ago; we must be getting close.

Seth Weintraub wrote this week on 9to5mac that a developer he met at MacWorld was building NFC into the next version of his app because Apple’s iOS engineers are “heavy into NFC.” Over on Fast Company, Austin Carr looked for clues in his conversation with Ed McLaughlin, who leads emerging payments at MasterCard. When Carr pressed McLaughlin for details on which handset makers were developing phones that work with MasterCard’s contactless payment system, he didn’t mention Apple by name but said he “didn’t know of any handset maker out there who wasn’t working to make their phones PayPass ready.”

Why do we read these tea leaves? There are a few other NFC phones out there already, pushing the far end of the envelope. But Apple is much more significant, as Carr points out, thanks to its:

“… magical ability to transform whole industries. No one paid for music digitally before Apple unveiled iTunes; virtually no one listened to MP3 players, or carried smartphones, or played with tablets before Apple entered the markets.”

Even more so than with previous trends, an enormous captive audience awaits the moment when Apple will introduce it to mobile payments. Scot Wingo notes, in a very good summary of the state of mobile commerce on Seeking Alpha, that Apple has “something like 250 million credit cards on file” in the iTunes store. Although only a fraction of those will buy the iPhone 5 in its first months out, they are sure to be customers who are already comfortable buying things through Apple’s interface.

I think the biggest and best surprise will be more than just the date when iPhones ship with NFC, but rather how Apple presents a mobile wallet interface. When you think of how iTunes presented a better way to buy digital music, and when you compare the customer experience in Apple’s retail stores with what you find almost anywhere else, you have to acknowledge Apple’s genius in what we might call the transaction interface. Its programming efforts up front seem as likely to mainstream mobile commerce as any programming that it does behind the scenes to make those transactions occur.

X.commerce harnesses the technologies of eBay, PayPal and Magento to create the first end-to-end multi-channel commerce technology platform. Our vision is to enable merchants of every size, service providers and developers to thrive in a marketplace where in-store, online, mobile and social selling are all mission critical to business success. Learn more at x.com.

X.commerce harnesses the technologies of eBay, PayPal and Magento to create the first end-to-end multi-channel commerce technology platform. Our vision is to enable merchants of every size, service providers and developers to thrive in a marketplace where in-store, online, mobile and social selling are all mission critical to business success. Learn more at x.com.What PayPal is learning at the point of sale

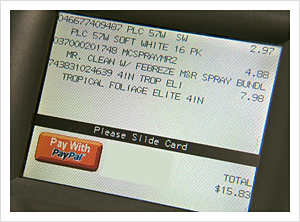

PayPal’s point-of-sale (POS) trial with 51 Home Depot stores is rolling out to Office Depot stores, too — cautiously, according to this Reuters story, which quotes an Office Depot executive saying “there are still some rough spots in that experience.” The executive didn’t say whether those rough spots had to do with the technology, the way customers are using it, or just the basic unfamiliarity with it. Regardless, the novelty presents something of an opportunity for PayPal, says Anuj Nayar, PayPal’s chief spokesperson. “Retailers are not technologists by nature,” Nayar told me in a conversation last week. “They have to work and sell in this multi-channel environment, where increasingly the differentiator is based on technology.” But keeping up with the evolving technology shouldn’t be the retailer’s job, Nayar says. PayPal, of course, wants to provide a commercial ecosystem — as Nayar calls it, “a one-stop tech partner for retail.”

PayPal had those capabilities on display at the National Retail Federation show last month, showing the various ways it is enabling payment at the point of sale. PayPal aspires to go beyond the concept of a mobile wallet in a phone; it wants to offer a “wallet in the cloud” that lets consumers make purchases with just their mobile number and a PIN — no card or phone needed. No doubt, the trials at Home Depot will shed light on just how comfortable consumers are with this idea. So far, Nayar says, it’s too early in the trial to share any of those learnings.

PayPal had those capabilities on display at the National Retail Federation show last month, showing the various ways it is enabling payment at the point of sale. PayPal aspires to go beyond the concept of a mobile wallet in a phone; it wants to offer a “wallet in the cloud” that lets consumers make purchases with just their mobile number and a PIN — no card or phone needed. No doubt, the trials at Home Depot will shed light on just how comfortable consumers are with this idea. So far, Nayar says, it’s too early in the trial to share any of those learnings.

Nayar did share a finding from PayPal’s conversations with consumers and retailers about how they want to use mobile commerce: You need to get beyond not only the friction that keeps people from using technology, but also guard against any social stigma that could arise. “For example, when I go to get coffee in the morning, if I get there and see there is a 20-minute wait, I can’t wait for that. That retailer has lost a customer because of a friction point. So how do you reduce that friction? Maybe it’s giving people the ability to order the coffee over their mobile before they get there? … But we tested that, and you know what we found? People don’t like to jump the line. They didn’t like the idea of coming in and looking to everyone in line like they were getting to skip the line. So, maybe you need a separate line and register, a PayPal Express line or something.”

In other words, we want convenience, but not at the expense of looking like we’re getting special treatment. No doubt, PayPal will learn more in the coming trials, which are ramping up quickly: The company wants to be at 2,000 points of sale by the end of March.

Square hits the hustings

Square picked up a fresh round of publicity this week when word broke that staffers from both the Obama and Romney campaigns were using its plug-in dongle card reader to collect political donations for their candidates.

Obama campaign spokesperson Katie Hogan told Nick Bilton of The New York Times that the dongles were being shipped out to campaign workers across the country. The Obama campaign also hopes to create a donation app that works in conjunction with Square dongles so that any supporter can collect contributions with or without the support of the local campaign organization. All donations would obviously go to the campaign — minus the 2.75% transaction fee that Square keeps from every transaction.

The Romney campaign’s digital director Zac Moffatt said the Republicans would also begin using Square as soon as this week, but he cautioned they want to make sure that using Square doesn’t break any rules. “The challenge on this sort of thing is never with the technology, it’s with the compliance. We’re making sure everything we’re doing follows fund-raising rules and is compliant with the FEC.”

Although DC is generally slow to embrace new technologies, I have a hunch that tech that makes it easier for candidates to collect money will find a swift and warm welcome.

Got news?

News tips and suggestions are always welcome, so please send them along.

If you’re interested in learning more about the commerce space, check out DevZone on x.com, a collaboration between O’Reilly and X.commerce.

Related: