"paypal" entries

Transparency and transformation at PayPal

PayPal has gone through a cultural transformation with radical transparency as a cornerstone of the plan.

Three years ago, PayPal was growing exponentially, staying profitable and was considered the most successful online payments company in the world. This should have been the recipe of a company that was attracting top talent across the globe, and keeping their core engineers happy, thriving, and innovative. But, at the time, the PayPal engineering team wasn’t where they needed to be to stay ahead of the curve — they didn’t have the process, the tools, or the resources to extend their talent and stay engaged in creating amazing products and services.

Leadership had encouraged the formation of engineering silos to “concentrate expertise,” but this made it incredibly challenging to get things done. At the same time, popular services such as Google and Amazon were raising the bar for everybody. All businesses — not just software-focused businesses — needed to have websites (and mobile apps) that were snazzy and responsive in addition to being reliable. PayPal engineering needed to push the proverbial envelope to stay competitive in a fierce and unrelenting industry landscape.

For PayPal, the transformation started at the edge of the stack. The Kraken project, which was started by an internal team to support a new checkout system, proved that an open source platform could reduce time to market and still perform at scale. This was achieved largely in spite of the silo culture that ran rampant and tended to restrict innovation and creativity. Support from senior management and perception of less risk at the edge of the stack helped the project and ultimately unleashed a gold rush of interest in repeating the win with releases of internally developed improvements to other open source projects. When I came into PayPal, I received an avalanche of mail from teams who wanted to “open source something.”

Upward Mobility: The Mobile Payment Problem

Mobile Payment is going to take a lot of cooperation by a lot of competing interests, or a clever end-run

There was a time when the two big unsolved puzzles of online finance were micropayments and mobile payments. Micropayments were a problem because no one seemed willing to make sub-dollar transfers economically viable, while mobile payments had a chicken-and-egg solution / vendor paradox. Sites like PayPal and Square seem to have finally resolved the micropayment issue, as are more out-of-left-field ideas like Bitcoins. Mobile payment is still a morass of competing solutions, however.

For a while, Near Field seemed to be the sword that would slay the dragon, but Apple’s continual refusal to adopt the technology would leave a big segment of the mobile market out of the play. Even if someone comes up with a new point of sale (POS) terminal leveraging the more universal Bluetooth Low Energy, the real challenge isn’t the hardware. The problem is getting dozens of POS vendors and all the banks that issue cards to sign onto a new standard, and getting enough stores and retail venues to adopt it. Chicken and the egg once again.

Commerce Weekly: Apple iWallet/NFC rumors reignite with newest patent application

iWallet may arrive yet, PayPal's new partnerships prepare for launch, and mobile payments hit fast food.

iPhone patent application focused on “a method for conducting a financial transaction”

The US Patent & Trademark Office published a new patent application from Apple this week that indicates potential advancement on the iWallet mobile payment front. Jack Purcher at Patently Apple dug in to find what set this patent application apart from other iWallet patent applications previously filed and found that this application “focused on ‘A method for conducting a financial transaction‘” (emphasis is Purcher’s).

The US Patent & Trademark Office published a new patent application from Apple this week that indicates potential advancement on the iWallet mobile payment front. Jack Purcher at Patently Apple dug in to find what set this patent application apart from other iWallet patent applications previously filed and found that this application “focused on ‘A method for conducting a financial transaction‘” (emphasis is Purcher’s).

Purcher pulled out 14 specific claims in the patent related to conducting a financial transaction. The first not only describes how the transaction will take place, but indicates near field communication (NFC) could be accommodated:

“1. A method for conducting a financial transaction comprising: taking a picture of a first code displayed on a transaction terminal using a camera of a portable electronic device; and sending data from the portable electronic device to the transaction terminal to conduct the financial transaction with the transaction terminal using a near field communication channel or another wireless communication channel, or both, wherein the data is derived from the first code to enable the transaction terminal to verify that the portable electronic device is physically located near the transaction terminal.”

Commerce Weekly: Intuit Pay heats up U.K. mobile payments market

Intuit Pay in the UK, PayPal Here vs Square Register, retail insights from SXSW, and FTC chimes in on mobile payments.

Intuit Pay enters U.K., PayPal Here takes on Square Register

On the heels of PayPal announcing it would bring PayPal Here to the U.K. later this year, Intuit launched its Intuit Pay mobile payments solution in the U.K. market. The platform includes a mobile app and a card reader, much like its competitors iZettle’s, Payleven’s and (soon) PayPal Here’s platforms.

Ingrid Lunden reported at TechCrunch that like its competitors, Intuit Pay will charge a per-transaction fee — in its case, a 2.75% flat rate — but unlike its competition, Intuit will offer its mobile payment card readers for free for a limited time. Lunden noted that Intuit Pay will be able to integrate with Intuit’s QuickBooks accounting software and its other business products, so offering the card reader for free doubles as an incentive for merchants to join Intuit’s business ecosystem.

The card reader at launch is available only for iOS devices, but Lunden reported that “other platforms like Android are on their way soon.”

In related news, PayPal launched PayPal Here for the iPad to compete with Square Register as a small business point-of-sale solution. Leena Rao reported at TechCrunch that the app — PayPal’s first native tablet app — features multiple log-in capability to accommodate multiple employees and multiple “cash registers,” and allows for a variety of payment methods, including swiping a credit card with PayPal Here, manual card number entry, and scanning a card using Card.io. Rao also noted that the app integrates with eBay’s RedLaser technology so merchants can scan barcodes to make a sale or even to add to their inventories, something Square Register isn’t yet capable of doing.

PayPal’s new iPad app only works in the U.S. using the PayPal Here dongle, but Rao reported that PayPal intends to integrate the technology with its international offerings in the future.

Commerce Weekly: PayPal marches toward ubiquity

New PayPal partners, mobile wallet disruption may hinge on Apple, and prioritizing mobile in a "lukewarm" market.

Here are a few stories that caught my attention in the commerce space this week.

PayPal expands its footprint with new partners

PayPal announced this week it has expanded its U.S. footprint to include 23 new partners for its PayPal in-store payments service, in addition to the 15 national partners announced last May, making its service available in 18,000 physical store locations across the country.

PayPal announced this week it has expanded its U.S. footprint to include 23 new partners for its PayPal in-store payments service, in addition to the 15 national partners announced last May, making its service available in 18,000 physical store locations across the country.

According to a post on the PayPal blog, new retail partners include Barnes & Noble, Office Depot, Foot Locker and Jamba Juice, and “two additional partners that [they] will share publicly soon.”

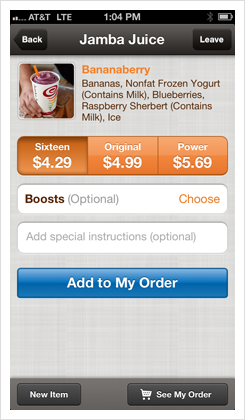

The deal PayPal struck with Jamba Juice goes beyond the in-store payments service that allows customers to pay with their phone number and a pin, or by using their PayPal payment card. Chloe Albanesius reports at PCMag that PayPal is testing its PayPal App in one Jamba Juice location to allow customers to place and pay for their orders, so when they arrive at the location, they just have to pick up their smoothie.

Global product VP Hill Ferguson notes in a post at the PayPal blog, that the feature is available only for iPhone users at this point and that there are plans to expand to more Jamba Juice locations this year.

In addition to its announcement of new retail partners, PayPal also announced a new hardware partner. Sarah Perez reports at TechCrunch that PayPal is “also partnering with point-of-sale and hardware maker NCR to expand into restaurants, as well as into other businesses, including gas stations and convenience stores.”

Commerce Weekly: Bringing mobile payment to the mainstream

PayPal snags two big partners, NFC is in the "Trough of Disillusionment," and a look at mobile commerce trends.

Here are a few stories that caught my eye this week in the commerce space.

The race is on

Earlier this month, mobile payment company Square teamed up with Starbucks to bring mobile payment to the coffee mogul’s 7,000 locations and millions of customers. This week, PayPal stepped up its game with two announcements. First, according to a report at Reuters, the company confirmed rumors that it’s running a mobile payment test with fast food giant McDonald’s at 30 of its locations in France.

Earlier this month, mobile payment company Square teamed up with Starbucks to bring mobile payment to the coffee mogul’s 7,000 locations and millions of customers. This week, PayPal stepped up its game with two announcements. First, according to a report at Reuters, the company confirmed rumors that it’s running a mobile payment test with fast food giant McDonald’s at 30 of its locations in France.

Alistair Barr describes the program in the Reuters report, explaining that customers can order lunch on their smartphones or online, pay with PayPal, and pick up their orders in a separate line. McDonald’s has more than 30,000 locations worldwide — landing this partnership not only could catapult PayPal ahead of Square in the mobile payment race, but it will bring mobile payments to the everyday lives of the masses, further mainstreaming the idea of mobile wallets and mobile payment.

Upping the ante further, PayPal also announced a partnership with Discover that, according to Ryan Kim’s report at GigaOm, will bring PayPal payments to some seven million U.S. merchants. Through the deal, Discover will integrate PayPal’s payment system into its point-of-sale software, which alleviates involvement and investment from merchants. During its launch, planned for April 2013, the system will be a bit clunky, but it’s expected to smooth out quickly thereafter — Kim reports:

“At launch next year, PayPal users will be able to pay with a PayPal Access Card, which connects to a PayPal account and can be funded from a bank account or credit card. Users will be able to use the card in conjunction with a PayPal mobile wallet app, which will deliver e-receipts, offers and other services. But a few months later, PayPal users will be able to pay directly through point-of-sale terminals by entering in a PIN or phone number or by authorizing a payment through their mobile app after sharing their location with the merchant. That will eliminate the need for any cards or traditional wallets and will enable consumers to get the benefits of a digital wallet to receive offers, track spending and tap into loyalty programs.”

PayPal’s VP of retail services Don Kingsborough told Kim this deal with Discover will be “key in achieving ubiquity” to help facilitate consumer adoption.

Commerce Weekly: Square disrupts, PayPal shrugs

Square's frictionless payment doesn't worry PayPal, NFC gets hacked, and mobile payments head to the Olympics.

A look at Square’s new payment app and why PayPal isn’t concerned, an NFC security hack is demoed at Black Hat, and Visa takes mobile payments to the 2012 Summer Olympics. (Commerce Weekly is produced as part of a partnership between O’Reilly and PayPal.)

Commerce Weekly: Amazon chases immediate gratification

Amazon's business strategy is showing, JC Penney CEO drops strategy bomb, and PayPal's strategy turns mobile.

Changes of heart in its war against state taxes illuminates Amazon’s next strategy, JC Penney will have mobile checkouts by the end of 2013, and PayPal acquires Card.io (Commerce Weekly is produced as part of a partnership between O’Reilly and PayPal.)

Commerce Weekly: Streamlining Facebook’s ads

One-click Facebook campaigns, PayPal redesigns, and a Best Buy exec identifies in-store mobile issues.

Payvment launches a one-click Facebook ad service, PayPal revamps its website with consumers and mobile in mind, and a Best Buy exec says in-store mobile use has a scale issue. (Commerce Weekly is produced as part of a partnership between O'Reilly and PayPal.)

Commerce Weekly: Streamlining Facebook's ads

One-click Facebook campaigns, PayPal redesigns, and a Best Buy exec identifies in-store mobile issues.

Payvment launches a one-click Facebook ad service, PayPal revamps its website with consumers and mobile in mind, and a Best Buy exec says in-store mobile use has a scale issue. (Commerce Weekly is produced as part of a partnership between O'Reilly and PayPal.)